Market Trends Shaping Executive Summary Quantum Communication Market Size and Share

Quantum Communication Market Size

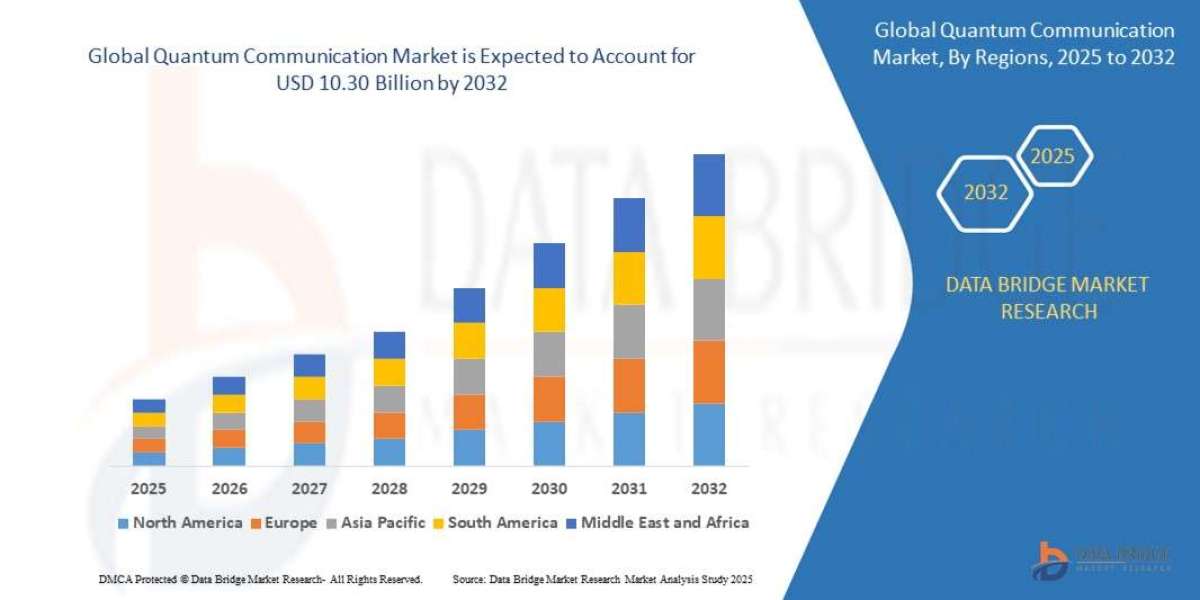

- The global quantum communication market was valued at USD 1.21 billion in 2024 and is expected to reach USD 10.30 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 30.70%, primarily driven by increasing concerns about data security and the need for advanced encryption solutions

- This growth is driven by rising government investments in secure communication infrastructure, the growing demand for quantum-resistant communication networks in industries such as finance, healthcare, and defense, and the increasing adoption of quantum key distribution (QKD) technology are driving market expansion

An extensive market research report like Quantum Communication Market report supports businesses to achieve detailed market insights with which gaining market place clearly into the focus becomes easy. This market research report brings into focus the comprehensive analysis of the market structure and the estimations of the various segments and sub-segments of the Quantum Communication Market industry. Moreover, it also performs the study of various parameters throughout the report which analyses the market status in detail. Market definition, market segmentation, key developments in the market, competitive analysis and research methodology are the major chapter of the persuasive Quantum Communication Market report which are again elaborated precisely and specifically.

The most advanced tools and techniques are applied to produce Quantum Communication Market report which gives the best experience to the business and the user. The report motivates clients to seek new business ventures and evolve better. This market research report reviews diverse markets at a global level in accord with the client’s requirements and scoop out the best possible solutions and detailed information about the market trends. Clients can explore new possibilities which are made feasible by the superior research methodologies, research tools and rich experiences. While preparing an international Quantum Communication Market report, two of the utmost values namely superiority and intelligibility are followed.

Unlock detailed insights into the growth path of the Quantum Communication Market. Download full report here:

https://www.databridgemarketresearch.com/reports/global-quantum-communication-market

Quantum Communication Industry Performance Overview

Segments

- Component: The component segment in the quantum communication market includes hardware and software. Hardware comprises devices such as quantum key distribution (QKD) systems, quantum sensors, optical fibers, and others. Software encompasses algorithms, protocols, and quantum network simulation tools.

- Vertical: The vertical segmentation in the quantum communication market covers various sectors like government and defense, banking, financial services, and insurance (BFSI), healthcare, IT and telecom, and others. Each vertical has unique requirements for secure communication, driving the adoption of quantum communication solutions.

- Deployment: Quantum communication solutions can be deployed on-premises or on the cloud. On-premises deployment offers dedicated infrastructure for organizations to ensure data security, while cloud-based deployment provides scalability and flexibility for businesses looking for cost-effective solutions.

- Region: Geographically, the global quantum communication market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each region has different levels of adoption of quantum communication technologies based on factors like regulatory environment, technological advancement, and investment in research and development.

Market Players

- ID Quantique: A leading player in the quantum communication market, ID Quantique offers quantum-safe network encryption solutions, QKD systems, and quantum sensing devices. The company focuses on providing secure communication for governments, enterprises, and research institutions.

- QuintessenceLabs: Known for its quantum key distribution solutions, QuintessenceLabs provides quantum-driven cybersecurity products to enhance data protection for organizations. The company's focus on encryption key management and random number generation is crucial for securing sensitive information.

- Toshiba Corporation: Toshiba Corporation is a key player in the quantum communication market, offering a wide range of quantum encryption technologies and quantum communication devices. The company's research and development efforts in quantum information processing contribute to the advancement of secure communication solutions.

- MagiQ Technologies: MagiQ Technologies specializes in quantum-safe cryptography solutions and quantum key distribution systems. With a focus on addressing cybersecurity challenges faced by businesses and government agencies, the company provides innovative products for secure communication.

The global quantum communication market is witnessing significant growth due to the increasing demand for secure communication solutions in various sectors. As organizations prioritize data protection and cybersecurity, the adoption of quantum communication technologies is expected to rise. Government initiatives to invest in quantum research and development further drive market growth. Key market players, such as ID Quantique, QuintessenceLabs, Toshiba Corporation, and MagiQ Technologies, play a crucial role in advancing quantum communication technologies and addressing the cybersecurity challenges faced by organizations worldwide.

The quantum communication market is poised for remarkable growth in the coming years as organizations across various sectors increasingly prioritize secure communication solutions to safeguard their sensitive data. With the rise in cyber threats and data breaches, the demand for quantum communication technologies is surging, driven by the need for robust encryption methods that can withstand the capabilities of quantum computing. As a result, market players are focusing on developing innovative solutions such as quantum key distribution systems, quantum-safe network encryption, and quantum sensors to cater to the evolving security needs of governments, enterprises, and research institutions.

In the component segment, the quantum communication market is characterized by a range of hardware and software offerings. Hardware components such as QKD systems, quantum sensors, and optical fibers play a vital role in enabling secure communication channels, while software solutions encompassing algorithms, protocols, and simulation tools are essential for optimizing network performance and ensuring data integrity. Market players are investing heavily in R&D to enhance the capabilities of these components and deliver comprehensive quantum communication solutions that meet the complex security requirements of different industries.

Vertical segmentation in the quantum communication market further highlights the diverse applications of these technologies across sectors such as government and defense, BFSI, healthcare, IT, and telecom. Each vertical presents unique challenges and opportunities for quantum communication solutions, with organizations in sectors like banking and healthcare increasingly leveraging these technologies to protect sensitive information and maintain regulatory compliance. The deployment options available, including on-premises and cloud-based solutions, offer organizations flexibility in choosing the most suitable infrastructure for their security needs, whether they prioritize dedicated on-site systems or cost-effective cloud deployments.

Geographically, the global quantum communication market is segmented into distinct regions with varying levels of adoption and investment in quantum technologies. North America and Europe are at the forefront of innovation in quantum communication, driven by strong government support, advanced research institutions, and a vibrant ecosystem of technology providers. In contrast, regions like Asia-Pacific, Latin America, and the Middle East and Africa are witnessing rapid growth in quantum communication adoption, fueled by expanding digital economies, increasing cybersecurity concerns, and rising investments in advanced technologies.

Overall, the global quantum communication market is poised for significant expansion, propelled by the growing demand for secure communication solutions and continued advancements in quantum technology. Market players are expected to intensify their efforts in developing cutting-edge quantum communication products and services to address the evolving cybersecurity landscape and meet the complex security requirements of organizations worldwide. As quantum communication becomes increasingly integral to data protection strategies, the market is set to witness sustained growth and innovation, transforming the way organizations secure their communications and critical information assets.The quantum communication market is undergoing a significant transformation driven by the escalating need for secure communication solutions across various sectors. The adoption of quantum communication technologies is on the rise as organizations prioritize data protection and cybersecurity in the face of increasing cyber threats and data breaches. With the emergence of quantum computing capabilities, there is a growing demand for robust encryption methods that can withstand advanced cyberattacks, propelling the adoption of quantum communication solutions.

In the component segment, market players are focusing on developing cutting-edge hardware and software offerings to enhance the security and performance of quantum communication systems. Hardware components such as quantum key distribution (QKD) systems, quantum sensors, and optical fibers play a crucial role in establishing secure communication channels, while software solutions like algorithms, protocols, and simulation tools optimize network efficiency and data integrity. Research and development investments in these components are driving the development of comprehensive quantum communication solutions tailored to meet the complex security requirements of diverse industries.

Vertical segmentation highlights the diverse applications of quantum communication technologies across sectors such as government and defense, BFSI, healthcare, IT, and telecom. Each vertical presents unique challenges and opportunities for quantum communication solutions, with organizations increasingly leveraging these technologies to protect sensitive information, ensure regulatory compliance, and bolster data security. The deployment options available, including on-premises and cloud-based solutions, offer organizations flexibility in choosing the most suitable infrastructure to meet their security needs, whether they prioritize dedicated on-site systems or cost-effective cloud deployments.

Geographically, regions such as North America and Europe are leading the innovation in quantum communication, supported by robust government initiatives, advanced research institutions, and a thriving technology ecosystem. In contrast, regions like Asia-Pacific, Latin America, and the Middle East and Africa are witnessing rapid growth in quantum communication adoption fueled by expanding digital economies, escalating cybersecurity concerns, and increasing investments in advanced technologies. The global quantum communication market is poised for substantial expansion as organizations continue to invest in secure communication solutions and market players intensify their efforts to develop cutting-edge products and services to address the evolving cybersecurity landscape and meet the intricate security requirements of organizations worldwide.

Overall, the quantum communication market is set for continued growth and innovation as quantum communication becomes increasingly integral to organizations' data protection strategies. Market players will play a pivotal role in shaping the market landscape by delivering advanced quantum communication solutions that provide enhanced security, reliability, and performance, transforming the way organizations secure their communications and critical information assets in the digital age.

Check out detailed stats on company market coverage

https://www.databridgemarketresearch.com/reports/global-quantum-communication-market/companies

In-Depth Market Research Questions for Quantum Communication Market Studies

- What figure represents the Quantum Communication Market’s current worth?

- What’s the projected pace of Quantum Communication Market growth year over year?

- What categories are used to divide the Quantum Communication Market?

- Which companies play a pivotal role in this Quantum Communication Market industry?

- What product updates or launches have occurred recently?

- What are the country-level insights provided?

- Which geographic area is growing most swiftly?

- What country could potentially lead in total Quantum Communication Market share?

- Which continent or region has the most active Quantum Communication Market?

- What nation is showing the highest annual growth trend?

Browse More Reports:

Global Aluminum Bottle Market

Global Cannabis-Based Wine Market

Global Cartoning Machines Market

Global Chlordane Market

Global Chocolate Ingredients Market

Global Clay Desiccant Bag Market

Global Complex Programmable Logic Device Market

Global Dental Instrument Delivery Systems Market

Global Digital Business Support System Market

Global Dodecanedioic Acid Market

Global Echinococcosis Treatment Market

Global Epoxy Primer Market

Global Filter Coating Market

Global Flavored Candy Market

Global Fraxiparine Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"