Got it — here’s a compact, source-backed market brief for the Carglumic Acid market (N-carbamylglutamate / CARBAGLU®), with a company reference table (companies + representative values or milestones) and the sections you requested. I used regulatory pages, company reports and industry market studies as the load-bearing sources — citations follow each section so you can open them.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Carglumic Acid market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Carglumic Acid market.

The intricately presented market report is in place to unravel all growth steering determinants, presenting a holistic overview and analytical delivery governing the realms of opportunity diversification, a thorough review of challenges and threats to plan and deliver growth driven business strategies.

Read complete report at: https://www.thebrainyinsights.com/report/carglumic-acid-market-14090

Company references (major players — representative values / milestones)

Notes: CARBAGLU® (carglumic acid) is marketed by Orphan Europe (Recordati Group). Several Indian / generic API and finished-dosage manufacturers list carglumic acid among products or APIs; many are small / private players so ingredient-level revenues are not publicly broken out. I list public group revenues where available to give scale context.

| Company / supplier | Representative value / milestone (most recent) | Source |

|---|---|---|

| Recordati — Orphan Europe (CARBAGLU® marketer) | Recordati group consolidated revenue: €2,341.6 million (FY 2024, preliminary / confirmed 2024 accounts). Marketing authorisation for Carbaglu is held by Orphan Europe (part of Recordati). | Recordati annual / preliminary results; EMA EPAR for Carbaglu. |

| Torrent Pharmaceuticals (mentioned as finished-dosage/contract manufacturer in market reports) | Group revenue FY24 ≈ ₹107,898 million (FY2024 reported). Named in industry competitor lists for carglumic acid generics/offerings. | Torrent financials / market company lists. |

| Zydus Lifesciences / Cadila (listed among suppliers in market overviews) | Zydus consolidated revenue (recent FY): ~₹23,511 crore (reported ranges in investor materials / FY figures); appears in market players lists for carglumic acid formulations/APIs. | Zydus investor pages & market lists. |

| Biophore India, Dipharma Francis, other API vendors (API / generic finished-dosage suppliers) | Private / regional manufacturers — appear in PharmaCompass / Pharma supplier directories and market reports as API / finished product sources (many list GMP / export capabilities). Financials usually private. | PharmaCompass supplier listings; Pharma market reports. |

| Market research providers (load-bearing market figures) | Market size estimates for the global carglumic acid market (2023/2024): ~USD 137–149 million (2023); forecast CAGRs ~7–7.5% (2024–2030/2032) depending on provider. | Grand View Research, GMI Insights, The Brainy Insights. |

Recent developments

Established orphan product with global approvals: CARBAGLU® (carglumic acid) has EU marketing authorisation through Orphan Europe and is distributed by Recordati in multiple territories (EMA/Health Canada authorisations cited historically).

Small but growing market & pipeline activity: market research houses report the global carglumic acid market at ~USD 137–149M (2023) and project mid-single digit to ~7%+ CAGR as diagnosis, awareness and formulations (e.g., orally disintegrating tablets) expand.

Broad supply base for API / generics: specialized API vendors and Indian manufacturers list N-carbamylglutamate on supplier directories (PharmaCompass, regional API manufacturers), indicating growing generic / contract manufacturing activity.

Drivers

Orphan disease treatment need & diagnostic improvements: carglumic acid treats hyperammonemia due to NAGS deficiency and is used as adjunct in certain hyperammonemic crises; better newborn screening and diagnostic capability raise identified patient counts.

Formulation innovation (e.g., ODTs) and hospital pharmacy adoption that ease dosing in neonates/critically ill patients. Market reports call out orally disintegrating tablets as a growth subsegment.

Expanded geographic registrations / distribution: Recordati/Orphan Europe’s regulatory approvals and national registrations (EU, US distribution agreements, Canada) support uptake.

Restraints

Very small patient population / orphan nature — absolute volumes remain limited, constraining market scale compared with mainstream therapeutics.

High treatment cost & reimbursement complexity in some markets – orphan drug pricing and payer approval processes may delay access. (Market reports note access and reimbursement as common barriers in orphan markets.) Manufacturing & supply constraints for niche APIs — many API suppliers are specialist, and supply-security / GMP compliance matters for hospital use.

Regional segmentation analysis

Europe: strong because CARBAGLU® was authorised centrally (EMA) and Orphan Europe / Recordati has a strong rare-disease distribution network.

North America: growing via national registrations and distribution (Recordati has U.S. distribution through Recordati Rare Diseases; Health Canada authorization exists). Uptake tied to specialist metabolic centres.

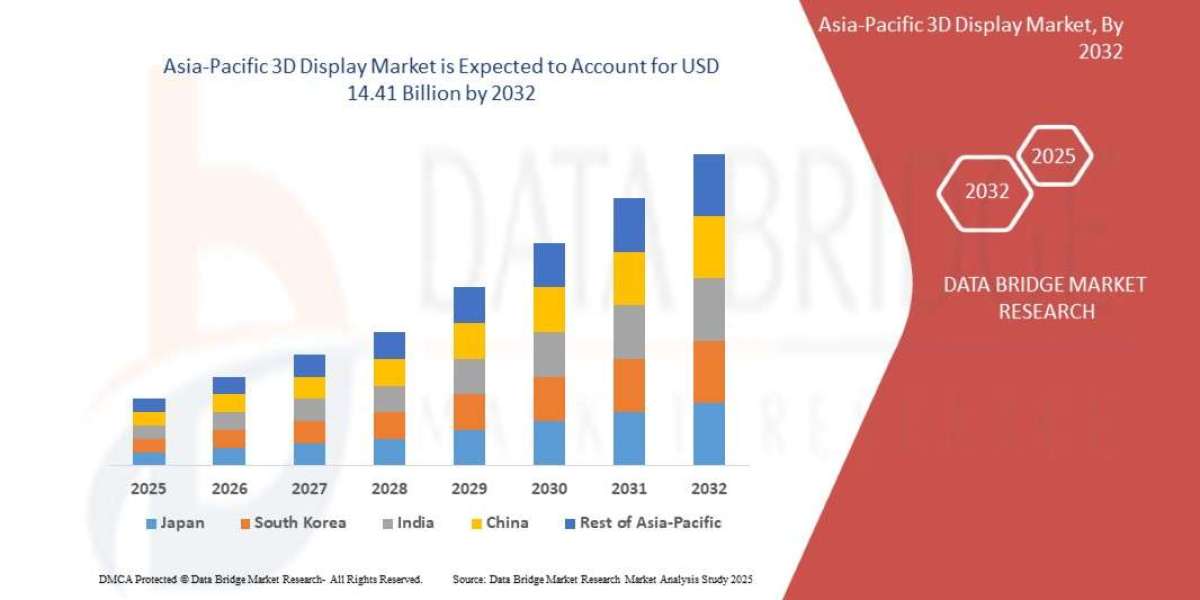

Asia Pacific & India: sizable activity among generics/API manufacturers — India features multiple listed suppliers (APIs / finished dosage) which supports regional access; market growth projected as diagnostics and newborn screening develop.

RoW (LATAM / MEA): variable — uptake depends on registration, specialist centres and payer coverage; market reports include these regions in forecasts but note slower penetration.

Emerging trends

ODT / paediatric-friendly formulations (improving administration during neonatal metabolic crises). Reports highlight orally disintegrating tablets as a prominent format.

Generic / contract manufacturing growth — directories and regional suppliers list N-carbamylglutamate APIs, indicating more supply options and potential price compression over time.

Greater emphasis on diagnosis & newborn screening programs that expand identified patient base for rare metabolic disorders.

Top use cases

Acute hyperammonemia crises in NAGS deficiency (primary approved indication).

Maintenance therapy to prevent recurrent hyperammonemia in diagnosed NAGS deficiency patients.

Adjunct use in metabolic/organic acidurias when appropriate (discussed in clinical literature and product monographs).

Major challenges

Small, highly specialized prescribing base (metabolic / biochemical genetics centres) — commercial outreach and sales models must be targeted and clinical.

Price / reimbursement negotiations for orphan drugs — payers often require strong evidence or risk-sharing for high-cost niche therapies.

Supply continuity for hospital pharmacies — single-sourced orphan products can face access problems if manufacturing or logistics issues occur.

Attractive opportunities

Improved diagnostics & newborn screening expansion that increase diagnosed patient numbers and eligible treatment population.

Paediatric-friendly formulations (ODTs, suspensions) and reimbursement dossiers demonstrating economic value (reduced ICU stays from faster crisis control).

Strategic licensing / regional partnerships for Recordati to increase presence in under-penetrated markets; and for generic/API suppliers to serve hospital and government tenders.

Key factors of market expansion

Wider screening & diagnostic uptake (identifies more patients earlier).

Regulatory registrations and payer coverage in additional countries (enables hospital procurement and standard-of-care adoption).

More API suppliers and manufacturing capacity (reduces supply risk and may expand affordability for health systems).