This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Online Banking market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Online Banking market.

The intricately presented market report is in place to unravel all growth steering determinants, presenting a holistic overview and analytical delivery governing the realms of opportunity diversification, a thorough review of challenges and threats to plan and deliver growth driven business strategies.

Read complete report at: https://www.thebrainyinsights.com/report/online-banking-market-14160

Company references (major providers with representative values)

Representative values use the most recent public company reports or reliable industry trackers (digital customers, revenues or digital-activity metrics).

| Provider | Representative recent value / metric (year) | Source |

|---|---|---|

| JPMorgan Chase (Chase) | ~71 million digitally-active customers (2024) across Chase digital channels. | JPMorgan Chase 2024 annual report / CEO letter. |

| Bank of America | >26 billion digital interactions in 2024; ~37.6 million clients opted into proactive digital alerts (2024) (shows scale of digital engagement). | Bank of America newsroom, Feb 2025 release. |

| Revolut (neobank) | ~65 million customers; ~£3.1B revenue & ~£1.1B pre-tax profit in 2024 (recent growth and secondary sale valuing company ~$75B in Nov 2025). | Company press + Reuters coverage (2025). |

| Chime (US challenger) | ~8–9 million active users (2024); revenue ~US$1.6B (2024) (private company estimates vary by tracker). | BusinessOfApps / industry trackers (2025). |

| Monzo (UK neobank) | ~9.3 million personal customers (2024); profitable FY2024 (company annual report). | Monzo Annual Report 2024. |

| N26 (Europe) | ~4.8 million revenue-relevant customers (end-2024); first quarterly profit reported in 2024. | N26 press / investor releases (2024). |

| Representative market sizing | Global online banking market estimates vary — IMARC: USD 4.4B (2024) → USD 6.1B by 2033 (CAGR ~3.6%); StraitsResearch & other providers report larger bases (USD ~21.8B in 2024) depending on scope and definition. | IMARC Group; StraitsResearch (different definitions). |

Recent developments

Massive user growth for challengers and incumbents alike. Large incumbent banks report accelerating digital activity (JPMorgan: ~71M digitally active customers) while neobanks (Revolut, Monzo, N26, Chime) scaled into multi-million customer bases and — in some cases — profitability or large funding / secondary liquidity events in 2024–2025.

Shift from ‘mobile app + basic services’ to ecosystems. Firms now compete on embedded finance (lending, wealth, crypto, BNPL, insurance), deep personalization and platform partnerships rather than simple account + payments. McKinsey and industry reviews highlight ecosystem monetization as a dominant theme.

Drivers

Customer behaviour: continual migration to mobile/online channels for everyday banking (payments, PFM, alerts). Large banks reported billions of digital interactions in 2024.

Fintech competition & customer acquisition models: challenger banks scale rapidly with low-friction onboarding, while incumbents invest heavily in UX, APIs and partnerships.

Regulatory & payments rails improvements: open banking/PSD2-style regimes, APIs and faster-payments rails lower friction for third-party services and embedded banking.

Restraints

Regulatory scrutiny & compliance costs (KYC/AML, consumer protection, crypto rules) — especially for high-growth challengers expanding cross-border.

Profitability / unit economics pressure for new digital banks — customer growth can be capital-intensive and margin-thin, requiring scale or cross-sell.

Fragmented definitions of the market (makes consistent sizing and benchmarking difficult, as shown by diverging market estimates).

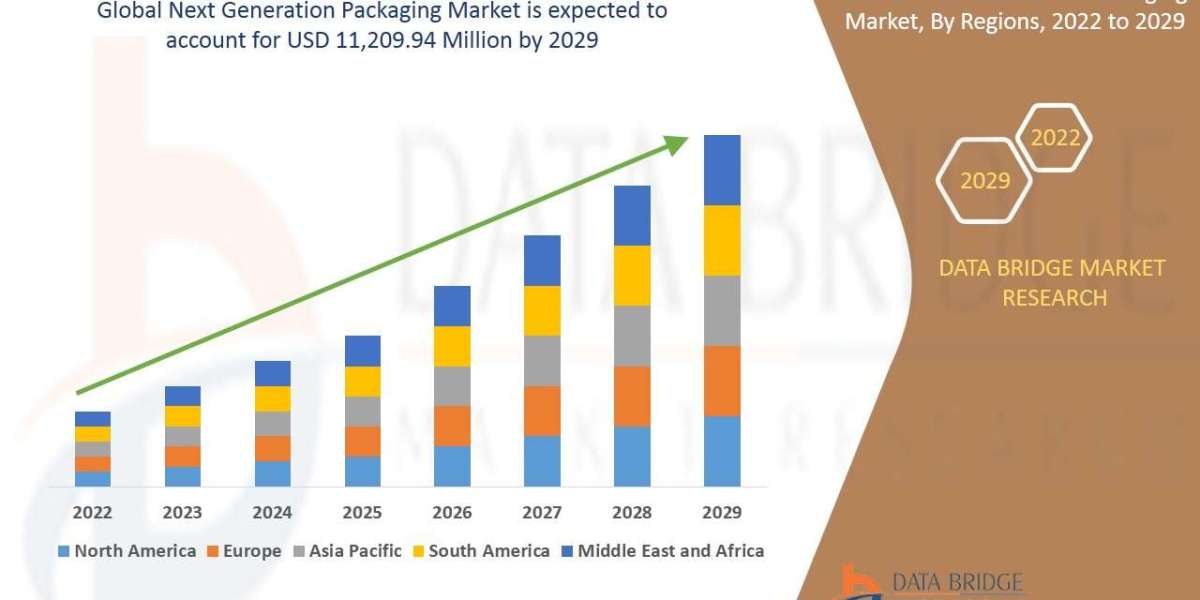

Regional segmentation analysis

North America: largest absolute revenue pools (big incumbents investing heavily in digital); rapid fintech scale-ups in the US (Chime, SoFi, Cash App ecosystem). JPMorgan/BoA report massive digital engagement.

Europe: dense challenger-bank ecosystem (Revolut, Monzo, N26) plus strong open-banking regulation; many neo banks originate here and scale across EEA.

Asia-Pacific: fastest adoption in some metrics (super-apps, mobile-first retail banking in China, India’s UPI growth supporting digital account activity) — incumbents and fintechs both scale fast here. (McKinsey global banking review notes regionally varied dynamics.)

LATAM / Africa / MEA: high digital leapfrogging opportunity where mobile-first banking and payments can expand financial inclusion quickly.

Emerging trends

Embedded finance & platformization: non-bank brands offering banking services via partnerships / Banking-as-a-Service (BaaS).

AI-driven personalization & risk management: banks deploy ML for credit decisioning, fraud detection, hyper-personal offers and chat/voice assistants.

Wallets, BNPL and crypto integration: digital banks are embedding payments, buy-now-pay-later and crypto trading into apps to increase engagement & revenue per user. Revolut & others are explicit examples.

Top use cases

Everyday retail banking: deposits, P2P, bill pay, real-time alerts.

Lending & credit at point of sale: instant credit, BNPL, overdraft alternatives.

Wealth & savings products in-app: investment, high-yield savings, robo advice.

Embedded banking for marketplaces & platforms: payroll, disbursements, merchant services.

Major challenges

Customer trust & fraud: digital channels increase attack surface; fraud prevention is expensive and critical.

Regulatory & cross-border complexity: licensing, data localisation and sandbox rules complicate rapid international expansion.

Monetization at scale: converting active users into profitable customers via lending, payments income, interchange and value-added services.

Attractive opportunities

Monetize data with personalized offers (credit, insurance, merchant partnerships) while respecting privacy/regulation.

SME banking & embedded B2B financial services — many challengers and incumbents target underserved small-business segments.

Cross-sell of higher-margin products (investing, insurance, international payments) inside an engaged app ecosystem.

Key factors of market expansion

Regulatory clarity & open-banking APIs that enable competition and new service models.

Improved digital ID & payments rails (faster payments, instant settlement) that reduce friction for onboarding and transactions.

Ability to demonstrate unit economics (customer LTV > CAC) via cross-sell, product breadth and operational efficiency.