"Executive Summary Mobile Payment Technologies Market Research: Share and Size Intelligence

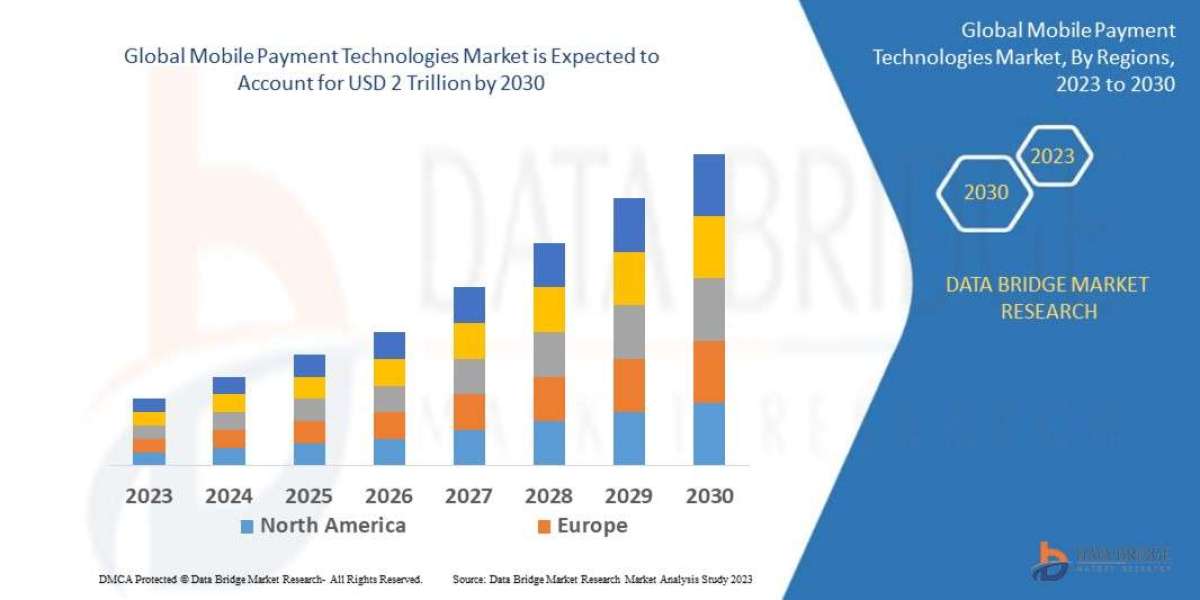

Data Bridge Market Research analyses that the global mobile payment technologies market which was USD 33 billion in 2022, would rocket up to USD 2 trillion by 2030, and is expected to undergo a CAGR of 37% during the forecast period.

Market research studies stated in this Mobile Payment Technologies Marketreport are very thoughtful for the businesses which assist them with the better decision making and develop better strategies about production, marketing, sales and promotion. This Mobile Payment Technologies Market report brings together comprehensive industry analysis with exact estimates and forecasts that offers complete research solutions with maximum industry clarity. The report includes CAGR value fluctuations during the forecast period of 2018-2025 for the market. And to serve the clients best in the industry, a team of experts, skilled analysts, dynamic forecasters and knowledgeable researchers work meticulously while forming this report.

This Mobile Payment Technologies Market report is an ultimate source of information about the industry, important facts and figures, expert opinions, and the latest developments across the globe. The report studies various inhibitors as well as motivators of the market in both quantitative and qualitative manner so that users can have perfect information. The base year for calculation in the Mobile Payment Technologies Market report is considered as 2017 while the historic year is 2016 which will tell you how the Mobile Payment Technologies Market is going to perform in the forecast years. The Mobile Payment Technologies Market report introduces the basics of industry such as market definitions, classifications, applications and industry chain overview, after which it covers industry policies and plans, product specifications, manufacturing processes, cost structures and so on.

Find out what’s next for the Mobile Payment Technologies Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/global-mobile-payment-technologies-market

Mobile Payment Technologies Market Dynamics

Segments

- By Payment Mode: Peer-to-Peer Transfer, Near Field Communication (NFC), Direct Carrier Billing, Mobile Wallets, Remote Payment

- By Purchase Type: Airtime Transfers & Top-Ups, Money Transfers & Payments, Merchandise & Coupons, Travel & Ticketing, Digital Products

- By End-User: Personal, BFSI, Media & Entertainment, Healthcare, Retail, Education, Hospitality, IT & Telecommunication

The global market for mobile payment technologies is segmented based on various factors to provide a comprehensive analysis of the industry landscape. By payment mode, the market is categorized into peer-to-peer transfer, near field communication (NFC), direct carrier billing, mobile wallets, and remote payment. The diverse nature of payment modes ensures that users have multiple options to choose from, enhancing the convenience and security of mobile transactions. In terms of purchase type, the market covers airtime transfers & top-ups, money transfers & payments, merchandise & coupons, travel & ticketing, and digital products. This segmentation highlights the versatility of mobile payments, spanning different industries and services. Lastly, the end-user segment includes personal, BFSI, media & entertainment, healthcare, retail, education, hospitality, and IT & telecommunication sectors, showcasing the widespread adoption of mobile payment technologies across various fields.

Market Players

- Apple Inc.

- Alphabet Inc.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- PayPal Holdings Inc.

- Mastercard Incorporated

- Alipay.com

- WeChat Pay

- AT&T

- Vodacom Group

Key market players in the global mobile payment technologies industry play a significant role in shaping the competitive landscape and driving innovation within the market. Companies such as Apple Inc., Alphabet Inc., and Samsung Electronics Co. Ltd. have been at the forefront of mobile payment technology advancement, offering secure and user-friendly solutions for consumers worldwide. Other major players like Visa Inc., PayPal Holdings Inc., and Mastercard Incorporated continue to expand their market presence by introducing new features and services to meet evolving consumer demands. Additionally, popular mobile payment platforms including Alipay.com, WeChat Pay, and regional players like AT&T and Vodacom Group contribute to the market's growth and development by providing diverse payment options for users.

The global mobile payment technologies market continues to witness significant growth and evolution driven by technological advancements, changing consumer preferences, and the increasing adoption of mobile devices worldwide. Looking beyond the segmented factors mentioned, it is essential to consider emerging trends that are shaping the market landscape. One key trend is the rise of contactless payments, which have gained traction due to the ongoing COVID-19 pandemic, as consumers seek safer and more convenient payment options. Contactless payment methods, particularly NFC-based solutions, are becoming increasingly popular in retail, transportation, and hospitality sectors.

Another notable trend is the convergence of mobile payments with other technologies such as artificial intelligence (AI) and blockchain. AI-powered chatbots and virtual assistants are being integrated into mobile payment platforms to provide personalized customer experiences and enhance security measures. Blockchain technology is also being explored for its potential to improve transparency, security, and efficiency in mobile transactions, particularly in cross-border payments.

Moreover, the market is witnessing collaborations and partnerships between mobile payment providers, financial institutions, and technology companies to enhance interoperability and expand the reach of mobile payment services. These strategic alliances are fostering innovation and creating seamless payment ecosystems that cater to the diverse needs of global consumers. Additionally, the increasing integration of mobile payment solutions in e-commerce platforms is driving the growth of mobile commerce (m-commerce) and paving the way for a more connected and digital economy.

Furthermore, regulatory developments and changing consumer behavior are influencing the market dynamics of mobile payment technologies. Regulatory bodies are introducing measures to ensure data security, privacy protection, and fraud prevention in mobile transactions, which are crucial for building trust among users and promoting widespread adoption. On the other hand, consumers are becoming more comfortable with mobile payments due to factors such as convenience, speed, and the availability of loyalty programs and rewards offered by mobile payment providers.

In conclusion, the global mobile payment technologies market is poised for continued growth and innovation as key players drive technological advancements, capitalize on emerging trends, and adapt to evolving regulatory landscapes. The increasing digitization of payment systems, coupled with the growing smartphone penetration and changing consumer behavior, are reshaping the way payments are made and processed worldwide. As the market continues to evolve, a focus on security, interoperability, and user experience will be critical for sustained growth and competitiveness in the mobile payment industry.The global mobile payment technologies market is witnessing a rapid transformation driven by various factors such as technological advancements, changing consumer behaviors, and regulatory developments. One of the key emerging trends in the market is the increasing popularity of contactless payments, particularly in the wake of the COVID-19 pandemic. Contactless payment methods, including NFC-based solutions, are becoming more prevalent across industries such as retail, transportation, and hospitality, as consumers seek safer and more convenient ways to make transactions.

Another significant trend in the market is the convergence of mobile payments with advanced technologies like artificial intelligence (AI) and blockchain. This integration is leading to the development of AI-powered chatbots and virtual assistants within mobile payment platforms, enhancing user experiences and strengthening security measures. Furthermore, blockchain technology is being explored for its potential to revolutionize mobile transactions by improving transparency, security, and efficiency, especially in cross-border payments.

The market is also experiencing a trend of collaboration and partnerships between mobile payment providers, financial institutions, and technology companies. These strategic alliances are aimed at enhancing interoperability and expanding the reach of mobile payment services, ultimately creating seamless payment ecosystems that cater to the diverse needs of global consumers. Additionally, the integration of mobile payment solutions into e-commerce platforms is driving the growth of mobile commerce (m-commerce), facilitating a more connected and digital economy.

Regulatory developments are another crucial aspect shaping the market dynamics of mobile payment technologies. Regulatory bodies are focusing on data security, privacy protection, and fraud prevention in mobile transactions to build trust among users and drive widespread adoption. At the same time, consumers are increasingly embracing mobile payments due to their convenience, speed, and the availability of loyalty programs and rewards offered by mobile payment providers.

In conclusion, the global mobile payment technologies market is poised for continuous growth and innovation, with key players driving advancements and adapting to evolving trends and regulations. The market's evolution towards more secure, seamless, and user-centric payment solutions underscores the importance of security, interoperability, and customer experience in sustaining growth and competitiveness in the mobile payment industry. The increasing digitization of payment systems, coupled with rising smartphone penetration rates, will continue to shape the future of mobile payments and pave the way for a more connected and efficient digital economy.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/global-mobile-payment-technologies-market/companies

Master List of Market Research Questions – Mobile Payment Technologies Market Focus

- What is the scope of the global Mobile Payment Technologies Market?

- What is the anticipated pace of growth for the Mobile Payment Technologies Market sector?

- What Mobile Payment Technologies Market segments are most profitable?

- Who are the powerhouses in the global Mobile Payment Technologies Market?

- What are the top-performing countries in the dataset for the Mobile Payment Technologies Market?

- What firms are ranked highest in revenue in Mobile Payment Technologies Market?

Browse More Reports:

Autoimmune Disease Diagnosis Market

Global Bile Duct Cancer Market

Global Blepharitis Drug Market

Global Cadmium Pigments Market

Global Chronic Idiopathic Constipation Treatment Market

Global Coated Abrasives Market

Global Critical Care Equipment Market

Global De-Extinction Biotech and Conservation Genomics Market

Global E-Lan Metro Ethernet Services Market

Global Facial Hair Care Wipes Market

Global Forage Analysis Market

Global Golf Shoes Market

Global Halitosis Treatment Market

Global Indoor led lighting Market

Global Internet of Things (IoT) Testing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"