Nice — here’s a concise, source-backed market reference for the Mild Hybrid Vehicles (MHEV) Market: top companies (with short “value / role” lines), recent developments, drivers, restraints, regional segmentation, emerging trends, top use cases, major challenges, attractive opportunities and the key factors that will expand the market. I used recent industry reports and news to support the most important claims — citations are after key statements.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Mild Hybrid Vehicles market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Mild Hybrid Vehicles market.

The intricately presented market report is in place to unravel all growth steering determinants, presenting a holistic overview and analytical delivery governing the realms of opportunity diversification, a thorough review of challenges and threats to plan and deliver growth driven business strategies.

Read complete report at: https://www.thebrainyinsights.com/report/mild-hybrid-vehicles-market-14289

1) Key companies — name + one-line value / role

OEMs (vehicle makers / adopters)

Toyota — leader in hybrid tech (expands mild-hybrid/48V variants across SUV and passenger lines to improve fuel economy with minimal cost/complexity).

Suzuki / Maruti (India) — aggressive adopter of mild/strong hybrid architectures for cost-sensitive markets; large volumes in compact segments.

Ford — deploys 48V and ISG architectures across petrol engines to achieve fleet CO₂ targets in key markets.

Hyundai–Kia — integrating ISG/48V solutions across mainstream models; partnerships with suppliers for next-gen systems.

Volkswagen Group / Stellantis / Nissan / Honda / BMW — broad adoption across regions as a lower-cost electrification step before full hybrids/EVs.

Tier-1 suppliers & component specialists (critical enablers)

Bosch — major 48V systems and integrated starter-generator (ISG) supplier to OEMs.

Continental — power-electronics, ISG and control units for mild-hybrid architectures.

Valeo — ISG / 48V deals (multi-year supply agreements) and recent product updates for 48V architectures.

Denso / BorgWarner / ZF / Hitachi / Aptiv / Infineon / Schaeffler — battery modules, power electronics, motor drives and semiconductor suppliers that supply complete 48V ecosystems.

Commercial reports commonly list these OEMs and suppliers as the dominant ecosystem players for MHEVs/48V systems.

2) Recent developments (2024–2025 highlights)

OEM launches of 48V mild-hybrid variants (e.g., Toyota introduced 48V mild-hybrid versions of popular SUVs in 2025), showing the technology is moving rapidly from optional to mainstream trims in multiple markets.

Supplier product rollouts & OEM supply deals — Valeo, Bosch and others announced upgraded ISG / i-STARS systems and multi-year supply agreements with large OEMs to support next-gen mild-hybrids.

Market forecasts & rising 48V content — industry reports project sizeable growth in 48V system penetration (48V systems market forecasts and MHEV market CAGR projections vary by source but indicate accelerating adoption through the late 2020s).

3) Drivers

Regulatory pressure on CO₂ / fuel economy — tightening fleet emissions targets in Europe, China and elsewhere push OEMs to add low-cost electrification like mild hybrids to reduce real-world CO₂.

Cost-effective electrification step — 48V / ISG architectures give measurable fuel/emissions gains at lower cost and complexity than full hybrids or BEVs.

Broader availability of 48V components & proven suppliers — mature supplier ecosystem (motors, power electronics, semiconductors) lowers integration risk.

Consumer fuel-cost sensitivity — higher fuel prices and fleet operators seeking operating savings increase demand for incremental efficiency gains.

4) Restraints

Limited absolute fuel savings vs. full hybrids/BEVs — mild hybrids typically deliver modest (%) improvements compared with full hybrid/plug-in options, limiting appeal to consumers prioritizing large fuel savings.

Competition from full hybrid and BEV rollouts — as battery costs fall and policy incentives for EVs grow, some OEMs may leapfrog to stronger electrification, reducing future MHEV upside.

Incremental cost & complexity for OEMs — even “mild” electrification adds sourcing, calibration and warranty complexity that some manufacturers must manage.

5) Regional segmentation analysis

Europe — early and large adopter due to strict CO₂ rules and high diesel/petrol taxation; high 48V penetration in passenger cars and light commercial vehicles.

Asia-Pacific (China, India, Japan, Korea) — major growth engine: China and India show strong MHEV uptake as OEMs balance cost and emissions; Japan/Korea have strong supplier ecosystems and localized models. Toyota / Suzuki / local OEMs are major drivers.

North America — selective adoption (truck and SUV segments), driven by fuel-economy rules for fleets and consumer demand in higher-trim models.

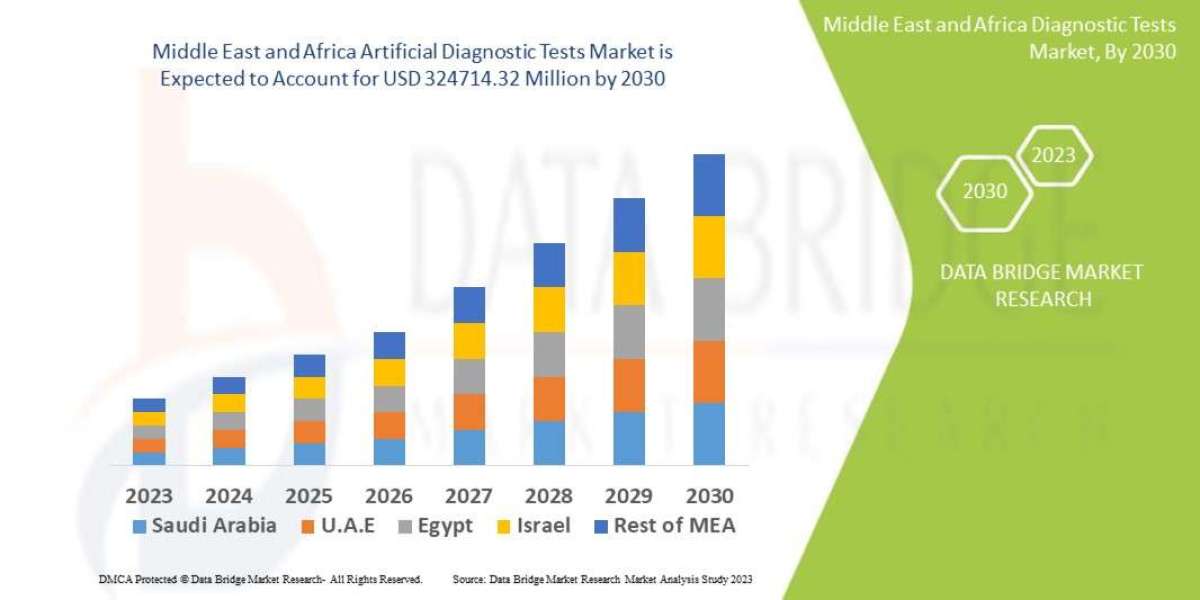

LATAM / MEA — nascent but attractive for cost-sensitive fleets and markets where BEV charging infrastructure is limited.

6) Emerging trends

Wider use of 48V architectures (P0/P2 ISG) enabling torque assist, more effective regenerative braking and quiet start/stop.

Integration with mild hybrid software stacks (energy management, predictive assist using navigation/route data) to squeeze more efficiency out of small batteries and motors.

Modular 48V solutions from suppliers (plug-and-play ISGs, battery modules) to shorten OEM integration cycles and reduce cost.

Use in larger vehicle segments (SUVs and light commercial vehicles) where benefits to fuel economy and torque are most valued.

7) Top use cases

Mainstream passenger cars & SUVs — fuel-saving coasting/assist, smoother start/stop and reduced engine load during acceleration.

Light commercial vehicles / delivery fleets — lower operating cost and emissions for high duty cycles without full hybrid expense.

Mild performance uplift — small electric torque assist in turbo-downsized engines to improve drivability and reduce turbo lag.

8) Major challenges

Demonstrating clear TCO value to fleet buyers and consumers beyond branded marketing claims — OEMs must prove lifetime savings against higher upfront cost.

Standardization & supplier concentration risks — different 48V architectures and control strategies complicate aftermarket and cross-OEM compatibility.

Semiconductor & battery raw-material supply chain — even for 48V systems, chips and cells are required and can be constrained.

9) Attractive opportunities

Fleet electrification “bridge” — rental, delivery and municipal fleets can use MHEVs to hit interim emissions targets affordably. Aftermarket / retrofit solutions for commercial fleets where OEM replacement cycles are long.

Supplier differentiation via turnkey 48V kits (ISG + battery + control) sold to small OEMs / converters.

Emerging markets — where full EV charging is limited, MHEVs offer emissions and fuel benefits with lower infrastructure needs.

10) Key factors of market expansion (summary)

Regulatory tightening on CO₂ / fuel economy that favors low-cost electrification (mild hybrids as a cost-effective compliance route).

Falling component costs and mature supplier offerings (modular ISGs, 48V battery packs, power electronics).

OEM product strategy to electrify entry and mid price tiers quickly (volume impact).

Fleet and commercial demand where TCO improvements are easiest to quantify and capture.

Complementarity with other efficiency tech (turbo downsizing, start-stop fine-tuning, lightweighting) to stack gains without full BEV investment.