Below is a compact, research-ready market reference for the Cryogenic (cryovial) vials market with company references (and company-level values where publicly reported), recent developments, drivers, restraints, regional segmentation, emerging trends, top use cases, major challenges, attractive opportunities, and the key factors that will determine market expansion. Sources for the most important claims are cited inline.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Cryogenic Vials market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Cryogenic Vials market.

Read complete report at: https://www.thebrainyinsights.com/report/cryogenic-vials-market-13185

Market snapshot (headline numbers)

Market size (vendor range): recent vendor estimates vary by scope, but cluster in the hundreds of millions USD today with steady growth. Examples: ResearchAndMarkets: USD 582.7M (2025) → USD 843.0M (2032), CAGR ~5.4%; Future Market Insights: USD 172.4M (2025 baseline under a narrower scope) → USD 262.7M (2035), CAGR ~4.3%; Technavio / Databridge report mid-single-digit CAGRs over 2023–2028. Use the vendor whose scope best matches your slide (some vendors include accessories and storage products; others only count vials).

Reference of companies (who to cite) — product role + cited values

Thermo Fisher Scientific (brands: Nalgene, Nunc, Thermo Scientific cryovials) — market leader in life-science consumables and labware. Thermo Fisher full-year revenue (2024): USD 42.88 billion. Thermo Fisher is widely cited as a leading supplier of cryogenic vials and related consumables.

Corning Incorporated (Axygen / Corning labware ranges) — major glass & plastic labware supplier whose product family includes ultra-low-temperature storage consumables and vial products. Corning GAAP sales (2024): ~USD 13.1 billion (core sales ~USD 14.5B).

Greiner Bio-One — specialist in tubes, vials and labware (strong cryo-product lines). Greiner Bio-One reported sales ~€666M (2024, Bio-One unit / group figures cited in Greiner materials).

Eppendorf SE — life-science consumables and sample handling specialist (sells Safe-Lock cryotubes and related products). Eppendorf consolidated revenue (FY2024): €980.3M.

Sarstedt — global supplier of medical & laboratory consumables including cryovials (large privately-held group; sales estimates vary across data aggregators). Industry data sites show Sarstedt as a mid-hundreds-of-millions EUR company (market data snapshots / company pages).

Other notable / niche suppliers frequently listed in market reports: DWK Life Sciences (incl. Wheaton/Duran glassware), E&K Scientific, Azer Scientific, InCell Technologies, Biologix, Cryo.Care — these are often cited as important regional or specialty competitors for cryovials and accessories. (Market reports / Databridge list these in competitor lineups.)

Recent developments (2023–2025)

Steady demand from biobanking & cell-therapy supply chains (sample storage and long-term biorepositories) is a major immediate driver for cryovials and associated consumables. Market reports link biobanking and cell-cryopreservation growth to cryovial demand.

Consolidation & broader supplier portfolios: large lab-consumable players (Thermo Fisher, Corning, Greiner, Eppendorf) continue to expand cryogenic product ranges and bundle vials with racks, labels and automated handling solutions. Market reports highlight product-line expansions and bundle offerings.

Drivers

Growth of biobanking, precision medicine and clinical trials — more samples → more cryovials. (Biobanking market growth cited).

Cell & gene therapy manufacturing and tissue banking — GMP sample storage needs and regulated cold-chain storage increase consumable demand.

Trend to single-use, barcode-traceable consumables & automation (robot-friendly vial geometries, 2D/1D barcode cryo vials) — labs prefer pre-labelled/trackable cryo vials to reduce errors.

Restraints

Price pressure & commoditization — cryovials are a mature consumable; competition from low-cost suppliers places pressure on margins for branded vials.

Supply chain & raw-material volatility — specialized polymers and precision moulding capacity can bottleneck supply during demand spikes.

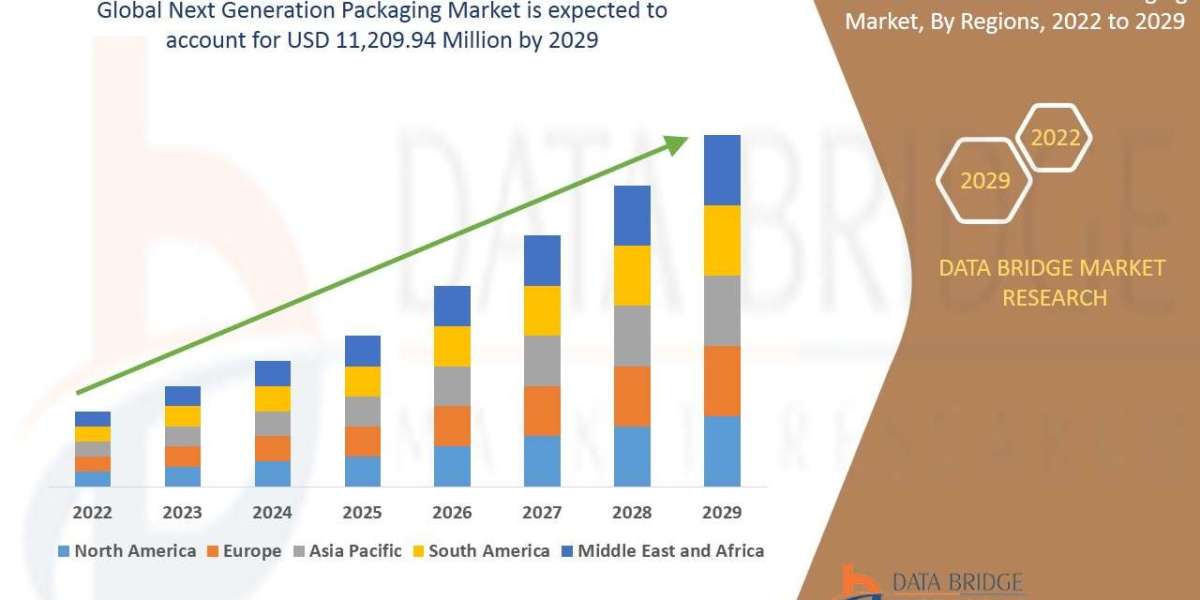

Regional segmentation analysis

North America: largest value market for cryogenic storage consumables due to large number of biobanks, pharma/biotech and clinical trial activity. Thermo Fisher, Corning and local distributors dominate.

Europe: strong institutional biobanking and academic research demand; major suppliers (Eppendorf, Sarstedt, Greiner) have strong footholds. Regulatory and GMP requirements drive demand for certified cryovials.

Asia-Pacific: fastest growth (higher CAGR) driven by expansion of research infrastructure, CROs and emerging biobanks in China, India and SE Asia — many suppliers are scaling production/export.

Emerging trends

Automation-friendly cryovials & racks — vials designed for robotic pick-and-place, 2D datamatrix 2D-coded cryo vials for LIMS integration.

Low-bind / DNA-free and certified GMP consumables — to meet higher-stringency QC for cell therapy and diagnostic sample storage.

Eco-design & recyclability conversations — some buyers pushing for lower-carbon supply chains and recyclable packaging for consumables (early stage).

Top use cases

Biobanks & specimen repositories (human tissue, blood components).

Clinical trial sample storage & central labs (longitudinal sample archiving).

Cell & gene therapy / regenerative medicine supply chains (cryostorage of cell banks and intermediates).

Research labs (academia & pharma R&D) for long-term sample preservation and reproducibility.

Major challenges

Standardisation gaps across vial types (dimensions, cap seals, labelling) can complicate automation and cross-lab sample exchange.

Cold-chain management costs (freezer footprint, LN2 logistics) — vials are only one part of total sample storage cost; customers weigh vial price vs total cost of ownership.

Attractive opportunities

Value-added product bundles (pre-barcoded vials + racks + LIMS integration / kit sales) — higher ASP and stickier customer relationships.

Emerging-market distribution & localized manufacturing — regional suppliers that reduce lead times and freight costs can capture share as APAC biobanking expands.

Specialist cryovials for cell therapy (GMP-grade, validated supply chains) — premium segment with higher margins.

Key factors of market expansion

Biobanking & cell-therapy pipeline growth — direct multiplier for vial volumes.

Automation & laboratory digitalisation (barcoding/LIMS) — increases demand for standardised, traceable cryovials.

Supply reliability & local manufacturing presence — reduces lead times and protects research pipelines from supply shocks.