below is a compact, sourced market reference for “Mobile Phone / Mobile Accessories Market” with company references + values and the exact sections you asked for. I kept it practical (company → role → a concrete value/metric you can use) and cited the most important sources so you can follow up.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Mobile Phone Accessories market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Mobile Phone Accessories market.

Read complete report at: https://www.thebrainyinsights.com/report/mobile-phone-accessories-market-12811

Company references (companies that matter for mobile phone accessories)

Anker Innovations — Role: Leading third-party accessory OEM (chargers, power banks, cables, audio, cases).

Key metric: ~$3B annual revenue (2024/2025 range; company-level sales used as proxy for accessories scale).Apple (Wearables, Home & Accessories segment) — Role: OEM + premium accessories (AirPods, MagSafe chargers, cases); market mover because Apple controls platform standards (MagSafe).

Key metric: Wearables, Home & Accessories net sales ≈ $37B (FY2024) — includes AirPods, Watch and accessories (useful benchmark for premium accessory demand).Belkin (Belkin International) — Role: Third-party leader in wireless charging & cable categories; retailer/brand partnerships.

Key metric: Public milestone: >1 billion products sold (press milestone; positions Belkin as a major accessory brand).Samsung (Accessories ecosystem) — Role: OEM (phones + branded cases/chargers/headphones) and platform influence on accessory standards (Fast Charge, Wireless PowerShare).

Key metric: Samsung’s broad electronics scale & accessories tie-ins are visible across quarterly business reports (used as strategic benchmark for OEM-led accessories).Spigen / OtterBox / Incipio / ZAGG — Role: Category leaders in protective cases & tempered glass (mass and premium protective segments).

Key metric: Frequently listed among the top phone-case manufacturers in market reports and company lists; used as benchmarks for the protective-case submarket.Anker Audio Brands (Soundcore), JBL/Harman, Sony, Logitech — Role: Major players in audio accessories (TWS earbuds, headphones, speakers) — the largest single subsegment by value in many reports.

Key metric: TWS/earbuds shipments and share are dominated by Apple, Samsung, Sony and major audio brands; TWS is a primary revenue driver in the accessories market.Regional/retail specialists (Xiaomi, Realme, Oppo ecosystem accessories; local brands like Ugreen, Baseus) — Role: High-volume, lower-price point accessories — important in APAC, LatAm and Africa.

Key metric: Strong unit volume and shelf presence on e-commerce marketplaces; often dominate value-sensitive regional markets.

Market size (why numbers vary) — headline figures (multiple reputable estimates)

global mobile accessories market ≈ USD 105.45 billion (2025), projected to ~USD 189.9B by 2033 (CAGR ~7.8%).

other analysts estimate USD 89–111B (2024–2025) with CAGRs 4–7% depending on definition (some reports track accessory revenue, others include wider product definitions and peripherals).

Business Research Company / ResearchAndMarkets: larger aggregated figures exist (some reports place 2024 market near $250–340B depending on scope — be careful: these often use broader definitions that include all mobile-related gadgets and replacement parts).

Recent Development (2023–2025 highlights)

Qi2 / MagSafe & wireless charging standardization — more mainstream adoption (IKEA, Belkin, OEMs launching MagSafe/Qi2 products), pushing sales for magnetic chargers/stands and MagSafe-compatible cases.

TWS earbuds & audio dominate growth — TWS shipments and replacement cycles make audio the fastest-growing subsegment in many reports.

Supply-chain & trade impacts — tariff changes and geo-trade tensions have led major OEM/OEM-adjacent brands (e.g., Anker) to adjust pricing and sourcing.

Drivers

Smartphone penetration & premium phone pricing → buyers seek protection, power and premium audio.

Functionality shift (wireless, fast charging, smart features) — wireless chargers, TWS earbuds, smart cases and IoT-enabled accessories drive higher ASPs.

E-commerce & marketplace channel expansion — easier distribution for third-party accessory brands.

Customization / Fashion / Sustainability — personalization (designer cases) and eco-friendly materials are influencing purchases.

Restraints

Fragmentation of phone models / ports / standards (e.g., MagSafe only for certain phones) increases SKU complexity and inventory costs.

Commoditization & price pressure from low-cost Chinese brands selling on marketplaces.

Device longevity / improved OEM durability can temper replacement-cycle spending for cases/repairs.

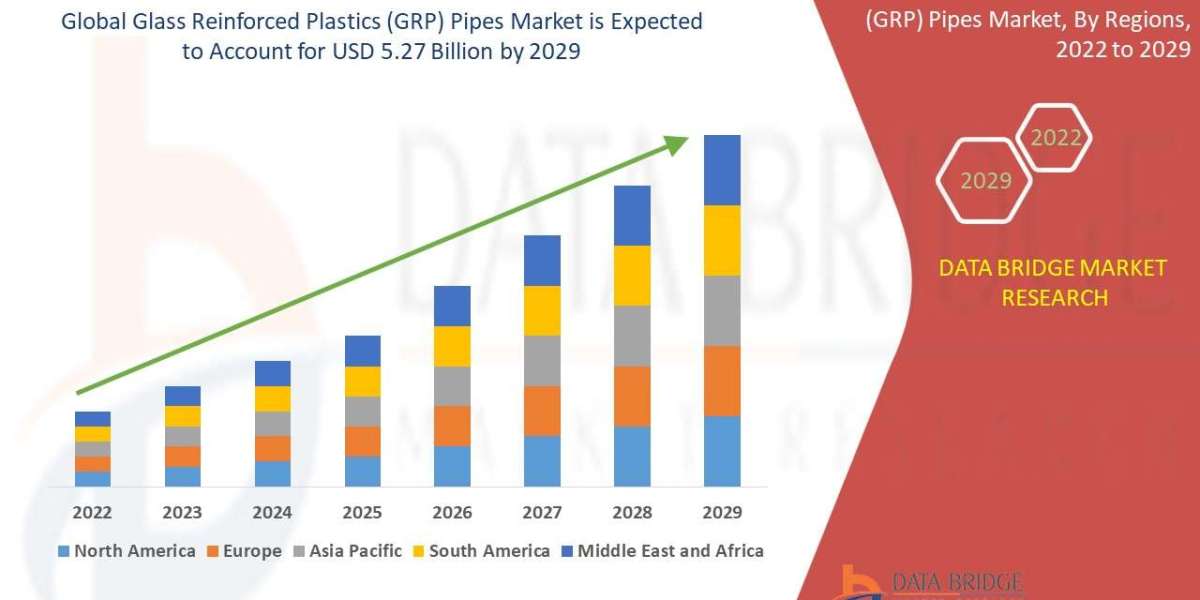

Regional segmentation analysis

Asia-Pacific: largest unit volume and fastest growth (huge demand in India, China, SEA; many local OEMs and low-cost accessory brands dominate).

North America: strong premium accessory demand (Apple-centric ecosystem, higher ASPs, big retail & carrier channels).

Europe: strong retail channels and emphasis on sustainability / design; MagSafe & wireless chargers growing.

Latin America & Africa: fast unit growth but more price-sensitive, dominated by local and Chinese imports.

Emerging Trends

MagSafe / Qi2 ecosystem & magnetic accessories (stands, wallets, mounts).

Smart / AI-enabled accessories (health-tracking cases, smart battery packs, IoT-connected peripherals).

Sustainability (recycled materials, repairable designs) — brands promoting lower carbon footprints.

Shift to offline+online omnichannel — strong continued role for brick-and-mortar (touch-and-feel matters for cases/chargers).

Top Use Cases (where money is spent)

Protection (cases, screen protectors) — highest unit penetration.

Power (chargers, power banks, cables) — repeat purchases and upgrades (fast chargers, PD adapters).

Audio (TWS earbuds, headphones) — largest value subsegment in many forecasts.

Convenience & mounts (car mounts, stands, grips) and lifestyle accessories.

Major Challenges

SKU & inventory management for many model-specific SKUs (cases, screen protectors).

Counterfeit & low-quality products on marketplaces — brand erosion & warranty issues.

Margin compression as competition intensifies and OEMs vertically integrate accessories (e.g., Apple/ Samsung bundles).

Attractive Opportunities

Premium branded accessories (collabs, licensed designer cases) — higher margin.

B2B & carrier channels (bundling accessories with device sales) — stable volume.

Accessory-as-a-Service / subscription models (insurance + replacement accessories).

Eco-friendly product lines to capture sustainability-minded buyers.

Key factors of market expansion (checklist)

Standardization of charging & magnetic standards (MagSafe / Qi2) → larger accessory ecosystems.

Continued TWS audio demand and higher ASPs driving market value.

E-commerce channel growth + omnichannel retail for discovery & impulse buys.

Affordable manufacturing + regional brands supporting unit growth in APAC/LatAm/Africa.

Brand partnerships (OEM + third-party) and retailer bundling to increase attach rates.