Packaging Printing Market Reference with Company Examples and Values across key strategic dimensions. All statements below are backed by recent market research insights.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Packaging Printing market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Packaging Printing market.

Read complete report at: https://www.thebrainyinsights.com/report/packaging-printing-market-12537

? Recent Developments

Company-level strategic moves and product launches

Toppan Printing Co., Ltd. expanded its packaging printing plant in China in 2023, boosting production capacity by ~30%.

DuPont de Nemours launched a new sustainable packaging printing ink line made from renewable materials.

Canon Inc. unveiled advanced digital printing systems tailored for personalized packaging in 2023.

Sealed Air introduced new digital printing solutions integrating directly onto finished packaging for customization.

Major Global Players (examples)

Amcor plc (CH)

Mondi Group (UK)

Smurfit Kappa Group plc (IE)

Sonoco Products Co. (US)

Toppan Printing Co., Ltd. (JP)

Quad/Graphics, Inc. (US)

WS Packaging Group, Inc. (US)

CCL Industries Inc. (CA)

Huhtamaki Flexible Packaging (FI)

International Paper Company (US)

? Drivers

Key forces propelling market growth:

Rising demand for premium and visually appealing packaging across FMCG, food & beverage, cosmetics, and pharma. Companies compete by offering high-resolution, customized printing.

Strong adoption of digital printing solutions (inkjet, electrophotography) for short runs, personalization, and faster time-to-market.

Focus on sustainability (eco-friendly inks & recyclable substrates), driving demand for innovative printing technologies.

Automation and smart workflow integration (AI-driven quality control, real-time calibration).

? Restraints

Key challenges limiting growth:

High costs of sustainable inks and alternative substrates, impacting smaller converters’ profit margins.

Capital-intensive upgrades to advanced printing lines (hybrid and digital presses) can be a barrier for mid-to-small players.

Regulatory complexity, especially around food-contact materials and recyclability standards, increases compliance costs.

? Regional Segmentation Analysis

Market share by geography (example 2024 figures)

North America – ~32.38% of global revenue, led by strong demand in food, beverage, and consumer goods packaging.

Europe – Significant demand in high-value sectors, with major players headquartered here.

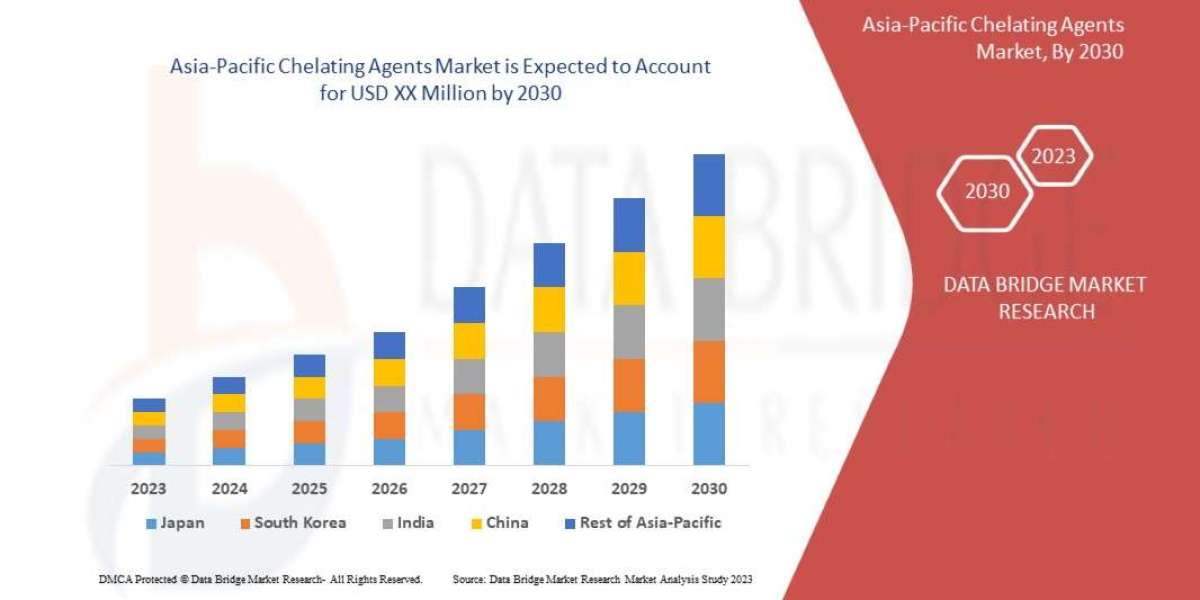

Asia Pacific – Rapid industrialization and e-commerce growth driving packaging printing volumes.

Latin America & Middle East/Africa – Growing packaging infrastructure and emerging consumer markets contribute to incremental demand.

? Emerging Trends

Digital & hybrid printing adoption increasing, enabling short runs, customization and variable data printing.

Eco-friendly materials & inks, with ongoing innovation to reduce VOC emissions and enhance recyclability.

Smart packaging integration (QR codes, RFID) which enhances consumer engagement and traceability.

Industry automation including predictive maintenance and real-time quality control using AI.

? Top Use Cases

Food & Beverages – Custom cartons, labels, flexible pouches dominate volume due to branding and safety needs.

Pharmaceuticals – High-quality labels and packaging that ensure regulatory compliance and traceability.

Cosmetics & Personal Care – Premium packaging with vibrant visuals for shelf impact.

Consumer Electronics & Retail – Branded boxes and point-of-sale packaging with high-resolution finishes.

Industrial & Logistics – Printed shipping labels, barcodes, and handling instructions.

⚠️ Major Challenges

Balancing sustainability with profitability due to higher costs of green materials and inks.

Fragmented market structure with many regional players making scale and technology investment uneven.

Skill shortages for operating advanced printing equipment and automation systems.

Standardization differences across regions complicating product development and compliance.

? Attractive Opportunities

Growth in e-commerce driving demand for branded, custom printed packaging.

Investment in digital printing and automation offering fast, flexible, and localized production models.

Sustainable packaging mandates creating space for eco-innovative printing solutions.

Hybrid and short-run printing demand from SMEs realizing personalization advantages.

? Key Factors of Market Expansion

✔ Technological innovation (digital presses, AI quality control) enhancing efficiency.

✔ Strong food & beverage and consumer goods sectors boosting volume printing demand.

✔ Investor focus on sustainability and eco-friendly materials.

✔ Regional expansion into APAC & Latin America with rising middle-class consumption.

✔ Shift to personalized & smart packaging solutions offering premium pricing opportunities.

If you need this built into a slide deck or Excel template (with values like market size, CAGR, and regional breakdowns) — just let me know what format you prefer!