Here’s a detailed market overview of the Bio-Lubricants Market with reference companies and values, plus structured insights on recent developments, drivers, restraints, regional segmentation, emerging trends, top use cases, major challenges, attractive opportunities, and key factors of market expansion — all grounded in industry data and credible research.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Bio-Lubricants market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Bio-Lubricants market.

Read complete report at: https://www.thebrainyinsights.com/report/bio-lubricants-market-14041

? 1. Reference Companies with Market Values / Positioning

Market Size Overview

The global bio-lubricants market was valued at ~USD 1.65 billion in 2024 and is forecast to grow to ~USD 2.67 billion by 2034 at a ~4.7 % CAGR.

Other sources estimate the market at ~USD 3.16 billion in 2024, growing to ~USD 5.09 billion by 2035.

Key Players & Example Market Presence

Major companies profiled in industry reports include:

| Company | Headquarters | Market Role / Notes |

|---|---|---|

| ExxonMobil Corporation | USA | One of the largest energy firms; over ~14.5 % market share in synthetic & bio-based lubricants. |

| Royal Dutch Shell PLC | Netherlands | ~12.8 % share in the wider synthetic & bio-based lubricant arena. |

| TotalEnergies SE | France | Active bio-lubricant manufacturer with next-gen product lines introduced 2024–25. |

| BP plc (Castrol) | UK | Longstanding lubricant brand expanding biodegradable/eco-label portfolios. |

| Cargill, Inc. | USA | Bio-based feedstock provider and bio-lubricant producer. |

| FUCHS Group | Germany | Holds ~11 % of bio-lubricants global share with ~250+ formulations in 40+ countries. |

| Panolin AG | Switzerland | Specialist bio-lubricants for industrial applications. |

| Renewable Lubricants Inc. | USA | Expanded plant in 2025 to boost production capacity. |

| Chevron Corporation | USA | Investing in plant-based ester tech for improved oxidation resistance. |

| Environmental Lubricants Manufacturing, Inc. | USA | Focus on environmentally acceptable lubricants (EALs). |

? 2. Recent Developments

✔ TotalEnergies SE introduced a new plant-based industrial lubricant range meeting strict EU sustainability standards in December 2024.

✔ Renewable Lubricants Inc. expanded production capacity by ~25 % in 2025 with a new Ohio facility.

✔ Chevron enhanced its plant-based ester platform in 2024, improving oxidation resistance by ~30 %.

✔ BP (Castrol) expanded its biodegradable hydraulic fluids and greases for heavy-duty and marine applications in early 2024, with plans to enter aviation bio-lubricants.

✔ Shell plc partnered with biotech firm Amyris Inc. in 2024 to develop advanced synthetic bio-lubricants using precision fermentation.

? 3. Drivers

? Stringent Environmental Regulations: Governments worldwide are imposing strict laws on petroleum-based lubricants, pushing industries to biodegradable alternatives.

? Sustainability & Corporate ESG Goals: Growing corporate emphasis on sustainability drives adoption of bio-based lubricants.

? Superior Performance Potential: Bio lubricants can offer competitive thermal stability, lubricity, and anti-wear properties for some industrial uses.

? Automotive & Industrial Manufacturing Growth: Expansion of automotive production and heavy machinery increases lubricant demand — with green alternatives gaining traction.

⚠️ 4. Restraints

❌ Higher Production Costs: Bio-lubricants often cost more to produce due to expensive renewable feedstocks and complex processing, hindering price competitiveness.

❌ Economies of Scale Limitations: Compared to conventional lubricants, bio variants still lack large scale production, maintaining higher pricing.

❌ Awareness and Performance Misconceptions: Some end-users remain cautious about performance parity vs. petroleum products.

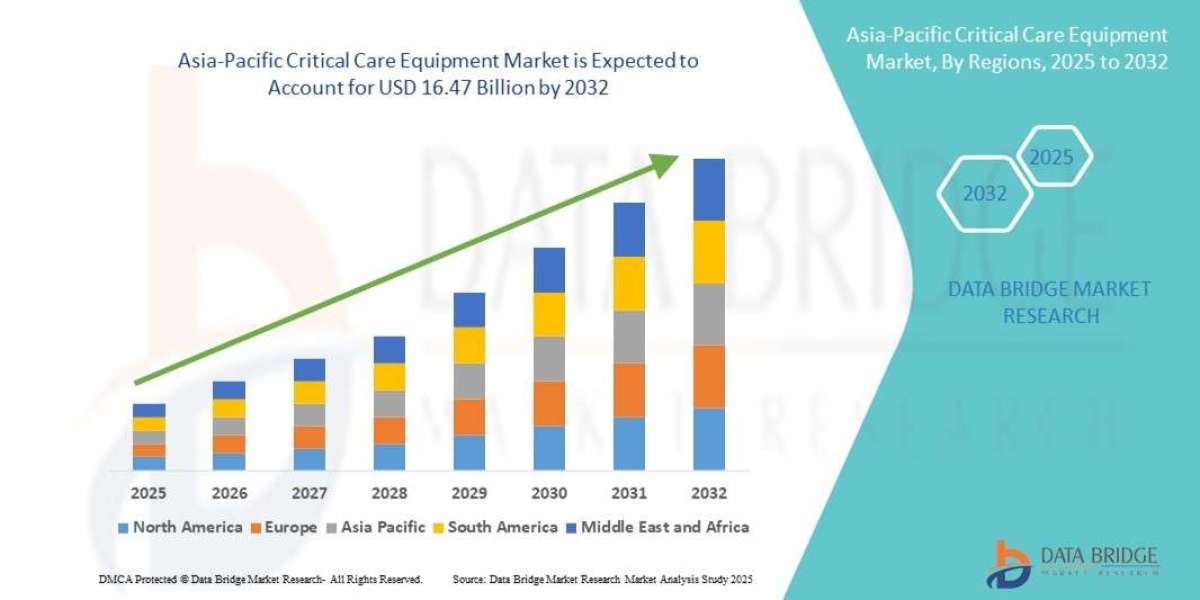

? 5. Regional Segmentation Analysis

? North America: Dominates global revenue share (~28–43 %) due to stringent environmental rules and advanced industrial demand.

? Europe: Strong regulatory environment and OEM adoption of eco-certified bio lubricants.

? Asia-Pacific: Fastest growing market owing to industrial expansion and environmental policy push, especially in China, Japan, and India.

? Latin America & MEA: Smaller but emerging markets as infrastructure and sustainability goals evolve.

? 6. Emerging Trends

✨ Biodegradable Marine & Aviation Fluids: Eco-certified marine lubricants complying with EAL standards (~>90 % biodegradation) gain adoption.

✨ Synthetic Ester Formulations: Innovations improving oxidation and thermal stability broaden application in harsher conditions.

✨ AI-Driven Formulation Modelling: R&D increasingly uses AI-assisted modelling to reduce development cycles and enhance performance.

✨ Expansion into Specialty Sectors: Railways, agriculture, and power generation explore bio lubricants for non-toxic, eco-safe operations.

? 7. Top Use Cases

? Automotive Lubrication: Engine oils, transmission fluids, and greases in passenger and commercial vehicles.

? Industrial Machinery: Hydraulic oils, metalworking fluids, and gear oils in factories and heavy equipment.

? Marine Applications: Biodegradable lubricants comply with maritime environmental mandates.

? Aerospace Fluids: Bio-based hydraulic and turbine oils expand aircraft compatibility.

? Agricultural & Forestry Equipment: Eco-safe lubricants reduce soil toxicity and equipment wear.

⚠️ 8. Major Challenges

❗ Performance vs. Traditional Products: Some bio formulations still lag in extreme temperature or longevity benchmarks vs. petroleum variants.

❗ Raw Material Price Volatility: Feedstock cost swings (e.g., vegetable oil) directly impact production economics.

❗ Limited Awareness in Emerging Regions: Adoption barriers remain in markets unfamiliar with eco lubricants.

? 9. Attractive Opportunities

✨ Policy Incentive Programs: Government subsidies and green procurement standards can boost adoption.

✨ Electric & Hybrid Vehicle Segment: Eco-friendly lubricants for EV transmissions and cooling systems present new demand vectors.

✨ Industrial Decarbonization Initiatives: Manufacturers seeking carbon footprint reductions may prefer bio alternatives.

✨ Emerging Market Penetration: Asia-Pacific and LATAM markets offer high-growth potential.

? 10. Key Factors of Market Expansion

? Environmental Regulations & Sustainability Goals — Stricter emissions and waste standards increase bio lubricant adoption.

? Technological Advancements in Formulations — Enhanced performance expands application breadth.

? Industrial & Automotive Sector Growth — Demand for eco solutions in expanding manufacturing and vehicle fleets.

? Consumer & Corporate ESG Focus — Sustainability commitments by OEMs and end-users bolster market uptake.

? Feedstock Innovation & Supply Chain Development — Broader feedstock sourcing (e.g., microalgae, waste oils) can reduce costs and expand markets.