Nice — here’s a focused, source-backed reference for the Airport Robots Market, organized exactly to your headings and with company references + the best publicly available values / deployment facts. I pulled market estimates and vendor deployment data from recent industry reports and company releases — the five most load-bearing facts are cited below.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Airport Robots market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Airport Robots market.

Read complete report at: https://www.thebrainyinsights.com/report/airport-robots-market-13429

Quick market snapshot (most load-bearing facts)

Market size (2024): ~USD 1.18–1.2 billion (multiple market reports).

Projected growth / CAGR: reports cluster broadly in the ~13.8% – 16.6% CAGR band across 2025–2034 horizons (different publishers / scopes).

Alternative estimate (shorter horizon): Fortune Business Insights shows a smaller baseline ($535.3M in 2024 in one time-series) but similarly strong growth to 2032 — market sizing varies by scope (service robots only vs. full airport-robot portfolio).

Company references (major players) — with values / deployment notes

Note: most market reports list top vendors but do not publish product-line revenue in free summaries. Where firms disclose deployments, production volumes, or corporate revenue relevant to robotics, I cite that.

Avidbots — Neo autonomous floor-scrubbing robot is widely deployed in airports (seven of the world’s top 10 airports and many major hubs). Deployment counts and case studies are public.

SoftBank Robotics / SBRA (Whiz / other cleaning cobots) — large-scale commercial deployments (Flagship / airport customers), nearly 100 autonomous cleaners across US sites reported in recent PRs.

Relay Robotics (Savioke / Relay) — autonomous indoor delivery robots used in airports, hotels and service areas; millions of deliveries claimed across deployments.

Knightscope — K5 autonomous security robots have been deployed to an international airport (San Antonio) and other public venues; public contracts and press releases document airport deployments.

Stanley Robotics — robot valet / automated parking systems deployed at airports (e.g., Lyon, Gatwick demonstrators); plays in airport parking automation.

Large systems & integrators named by market reports: SITA, LG Electronics, Hitachi, OMRON, Nilfisk/Kärcher (cleaning solutions), SIASUN, Karcher, Gaussian Robotics — referenced repeatedly as key players or integrators in industry coverage.

Recent developments (last 12–24 months)

Airports are accelerating deployments across cleaning (autonomous floor & UV disinfection robots), security (autonomous patrol robots), delivery/assistance (luggage & passenger guidance), and automated parking/valet systems — driven by labor pressures and hygiene/efficiency goals.

Vendors report growing enterprise-scale rollouts (example: SoftBank/Flagship nearly 100 cobots across ~15 sites including airports).

Drivers

Labor shortages & cost control — robots reduce routine staff load for cleaning, deliveries and perimeter patrols.

Health/hygiene requirements & passenger expectations (post-pandemic cleaning, contactless services).

Operational efficiency & 24/7 coverage (parking automation, security patrols, continuous cleaning).

Restraints

Integration & certification complexity inside busy airport environments (safety, navigation in crowds, airside/landside separation).

Privacy and regulatory/public acceptance (security robots raise data/privacy concerns; some public pushback reported).

Fragmented buyer procurement cycles & budget timing — airports move slowly on capital projects and require long validation.

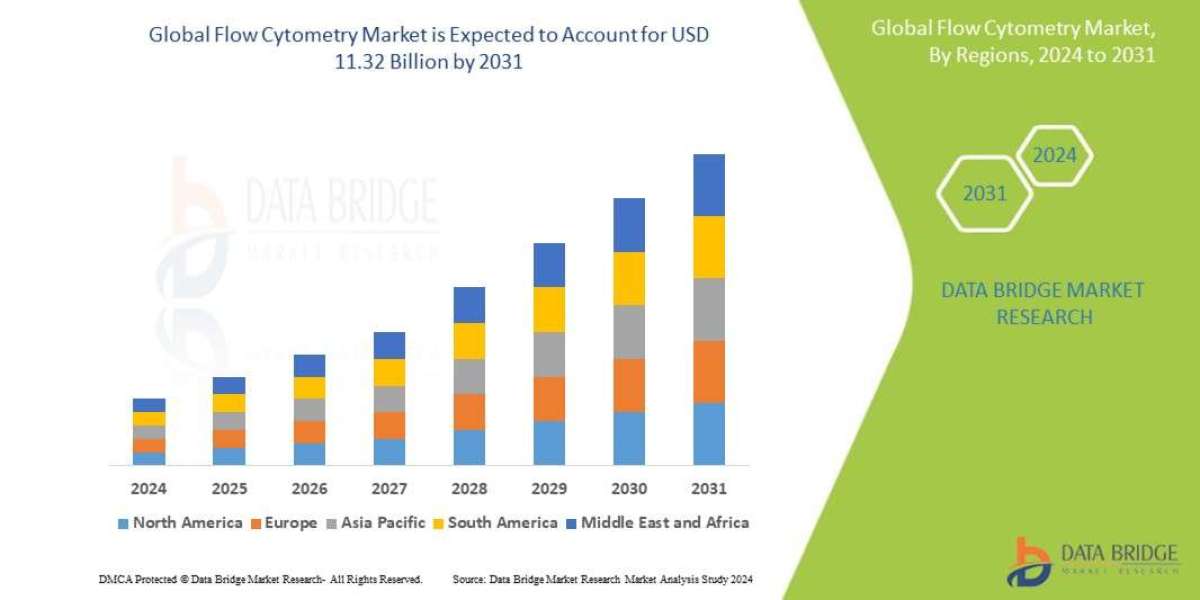

Regional segmentation analysis

North America & Europe: early adopters for security and cleaning robots; also strong in parking-valet pilots (Stanley, Knightscope, Knightscope press).

Asia-Pacific: large-scale pilots and deployments for service & hygiene robots (Changi, Haneda, Beijing airports historically active) and extensive vendor activity.

Middle East / LATAM / Africa: selective high-investment projects (passenger-experience pilots, security); growth potential as passenger volumes return.

Emerging trends

Vertical specialization: vendors focus on specific tasks (cleaning, security, delivery, parking) rather than single universal robot.

Fleet-management & cloud orchestration: airports prefer centralized robot fleets (scheduling, telemetry, predictive maintenance).

Shared services / robotics-as-a-service (RaaS): rental/subscription models to lower capex barrier for airports.

Top use cases

Autonomous cleaning (floor scrubbers, vacuums, UVC sanitizers).

Security & patrolling (autonomous mobile security units).

Indoor delivery & guest assistance (luggage guides, food/retail delivery, passenger guidance).

Automated parking / valet robotics (higher-density parking & faster throughput).

Major challenges

Safe navigation in crowded, dynamic passenger spaces (robust LIDAR/vision stacks required).

Demonstrating ROI & reducing false alarms / service failures in mission-critical airport roles.

Public perception & privacy concerns around surveillance-capable robots.

Attractive opportunities

Retrofit cleaning fleets & hygiene automation (fast ROI via labor savings).

Integrated multi-robot fleets (cleaning + delivery + security) under centralized management — upsell services, maintenance contracts.

RaaS / pay-per-use models for smaller airports to accelerate adoption without heavy capital outlay.

Key factors of market expansion (summary)

Passenger traffic recovery & higher throughput targets (airports invest in automation).

Labor economics & need for continuous cleaning/security (operational cost pressure).

Maturity of autonomy sensors & fleet orchestration software.

Flexible commercial models (RaaS / subscriptions) reducing purchase friction.

Quick list of useful sources (selected)

GM Insights (market sizing & CAGR).

Precedence Research (market sizing & forecast).

Fortune Business Insights (alternate market time-series).

Mordor / MarketResearchFuture (vendor lists / competitive landscape).

Avidbots / SoftBank / Knightscope / Stanley Robotics — company deployment press releases & case studies.

If you want this packaged into a deliverable, pick one and I’ll build it immediately:

Spreadsheet (Excel/CSV) — top 25 airport-robot vendors with HQ, robot types, notable airport deployments, and source links.

1–2 page competitive brief comparing the top 8 vendors (strengths, product fit, deployment examples).

3-slide PPT: market snapshot + top vendors + opportunities & recommended next steps.

Also — I pulled useful images of representative airport robots (cleaning, delivery, security, valet). If you want them in a 1-page visual brief or slide, tell me which deliverable (1, 2, or 3) and I’ll produce it now.