Nice — I pulled recent market reports, reviews and industry pages and put together a compact, referenced market brief for Sepsis Diagnostics with the sections you asked for. I cite the most relevant sources after each section so you can follow up. If you want, I can next extract company-level revenue numbers (public filings / investor presentations) for the players below — say which companies to prioritize and I’ll pull those figures.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Sepsis Diagnostics market.

Read complete report at: https://www.thebrainyinsights.com/report/sepsis-diagnostics-market-13651

Quick market snapshot (conflicting estimates from market research houses)

Market size (2024 estimates vary by source):

• Grand View Research: USD 1.14 billion (2024), projected to reach USD 1.81B by 2030.

• Fortune Business Insights: USD 918.0 million (2024) and a projection showing strong growth to 2032.

• RootsAnalysis / other houses: estimates range roughly USD 0.88–0.96B (2024–2025) with 7–10% CAGR in many forecasts. (different methodologies produce different bases).

Bottom line: market houses agree the market is sub-$2B today and is growing at roughly ~6–10% CAGR depending on forecast horizon and scope (biomarker tests, molecular assays, POC devices, culture-based services).

Key companies (major vendors / active players)

Most market reports list the following as leading players / active innovators in sepsis diagnostics (biomarkers, molecular ID, automated blood culture, POC tests, novel platforms):

bioMérieux (blood culture & ID systems; sepsis-focused assays)

Abbott Laboratories (biomarker & immunoassay platforms)

Thermo Fisher Scientific (molecular platforms, lab consumables)

Roche Diagnostics (immunoassays, molecular diagnostics)

Becton Dickinson (BD) (blood culture systems, sample prep)

Danaher (Beckman Coulter, molecular & clinical diagnostics subsidiaries)

Siemens Healthineers (lab diagnostics instrumentation)

T2 Biosystems (rapid pathogen detection directly from blood)

Bruker, DiaSorin, EKF Diagnostics, Sysmex, CubeDx, Response Biomedical and several niche / emerging firms (molecular rapid ID, host-response tests).

Note: most large diagnostics firms do not report “sepsis diagnostics revenue” as a single line — they report broader IVD / infectious disease segments. To get company-level sepsis revenue you typically need to pull product-level disclosures in annual reports or analyst note extracts.

Recent developments

Growing rollout of rapid molecular and POC sepsis tests (faster pathogen ID and AMR markers) and more commercial launches of multi-biomarker panels.

Increased emphasis on host-response biomarkers (PCT, IL-6, transcriptomic host-response signatures) and multi-marker algorithms to improve specificity and triage. Recent reviews (2024–2025) highlight multi-biomarker strategies.

Consolidation & product portfolio rationalization among large diagnostic players (firms refocusing on high-growth PCR/POC platforms). Example: industry moves by players such as Qiagen to focus on PCR/general molecular platforms (indicative of sector strategy).

Drivers

High sepsis incidence & hospital burden worldwide (sepsis remains a leading cause of in-hospital mortality). This sustains demand for faster diagnostics and monitoring.

Clinical need for rapid ID & antibiotic stewardship — faster results reduce time to targeted therapy and unnecessary broad-spectrum antibiotic use.

Technological advances — cheaper, faster PCR, microfluidics, host-response assays and POC platforms reduce turnaround times.

Health system initiatives & awareness campaigns pushing earlier sepsis recognition and standardized sepsis pathways.

Restraints

Limited specificity of single biomarkers (PCT/CRP/lactate) — false positives/negatives can drive inappropriate decisions. Multi-marker validation is still ongoing.

High cost of advanced molecular/POC systems and capital expenditure for hospitals, especially in low- and middle-income countries.

Regulatory / clinical validation hurdles for novel host-response or molecular assays — adoption requires robust clinical outcome data.

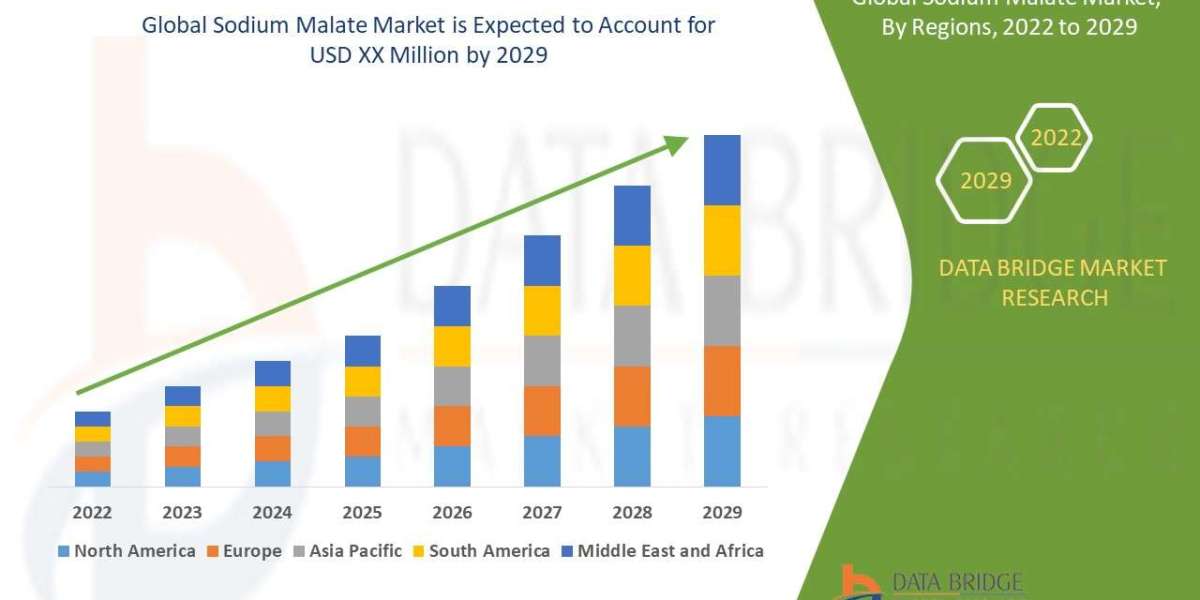

Regional segmentation analysis (high level)

North America — largest market share historically (strong hospital infrastructure, high sepsis awareness, rapid adoption of new tests).

Europe — second largest; reimbursement frameworks and guideline updates drive uptake.

Asia-Pacific & Rest of World — fastest growth (increasing healthcare investment, rising hospital admissions), but more sensitivity to test cost and infrastructure.

Emerging trends

POC & near-patient testing for sepsis biomarkers (to shorten time-to-result at ED/ICU).

Multi-biomarker and host gene-expression panels for better specificity and risk stratification.

Direct-from-blood molecular pathogen detection (culture-independent) to reduce culture wait times (companies like T2).

Integration with stewardship programs and EHR decision support (automated alerts/algorithms).

Top use cases

Emergency Department triage — rapid rule-in / rule-out and severity assessment.

ICU monitoring — trending biomarkers (PCT/lactate) to guide therapy and de-escalation.

Blood culture / pathogen ID acceleration — faster microbial identification to guide targeted antibiotics.

Antimicrobial stewardship programs — reduce unnecessary antibiotics and hospital length of stay.

Major challenges

Clinical validation at scale: proving that faster/better diagnostics change outcomes (mortality, LOS) — many studies are promising but more RCT / outcome data are needed.

Cost & reimbursement: payers require evidence of cost-effectiveness before broad reimbursement, especially for new platforms.

Complexity of sepsis biology: heterogenous host responses make one-size-fits-all diagnostics difficult.

Attractive opportunities

POC rapid multi-marker panels targeted at ED/ICU — high clinical value if they improve time-to-targeted therapy.

Culture-independent direct blood pathogen detection (molecular & nanoparticle approaches) — shorter time to organism ID & AMR cues.

AI/algorithmic integration combining biomarkers + vitals + EHR to predict sepsis earlier.

Emerging markets — lower cost, rapid tests designed for resource-limited hospitals present a large volume opportunity.

Key factors of market expansion

Validation that diagnostics improve clinical outcomes (not just analytical performance).

Falling costs and faster runtimes for molecular/POC platforms (improves adoption).

Regulatory approvals & reimbursement for new assays (PCT, multi-marker panels, direct pathogen tests).

Partnerships between large IVD firms and startups to commercialize niche rapid tests at scale.

Sources (select highlights)

Grand View Research — Sepsis Diagnostics Market (market size / forecast).

Fortune Business Insights — Sepsis Diagnostics Market (alternative market sizing & regional share).

MarketsandMarkets — Key players in sepsis diagnostics (company list).

Mordor Intelligence / GMI Insights / RootsAnalysis — company lists, segment analysis and forecasts.

Recent reviews & papers (2024–2025) on sepsis biomarkers and POC diagnostics (MDPI, NCBI/PMC).

If you want me to continue, I can (pick one):

Pull company-level sepsis diagnostics revenues / product revenues (from annual reports / investor presentations) for a shortlist of players (e.g., bioMérieux, Abbott, Roche, BD, Thermo Fisher).

Produce a ranked opportunity matrix (market attractiveness vs. competitive intensity) for sepsis diagnostic segments (POC biomarkers, molecular direct-from-blood, blood culture automation, host-response panels).

Create a one-page slide (PDF/PPTX) summarizing this brief for sharing.

Tell me which next step you want and I’ll fetch the company financials or build the slide.