Nice — below is a compact, source-backed market reference for the Global Homecare Medical Equipment Market: recent developments, drivers, restraints, regional breakdown, emerging trends, top use-cases, major challenges, attractive opportunities, key expansion factors — and a list of major companies with the values/metrics market reports commonly cite. I pulled multiple market reports and industry news; the most important statements carry citations so you can follow up.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Homecare Medical Equipment market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Homecare Medical Equipment market.

Read complete report at: https://www.thebrainyinsights.com/report/homecare-medical-equipment-market-13889

Quick load-bearing facts

Market size (2024 estimates vary by source & scope): recent industry reports place the global homecare / home medical equipment market in the USD ~158–416 billion range depending on how “homecare” is defined (device-only vs full home-health services). Example report estimates: USD 158.5B ( device-centric 2024) and broader home-healthcare market estimates like USD 285.3B and USD 416.4B

Typical forecast CAGRs: most forecasts cluster in the ~5–10% range (varies by horizon and scope — device-only forecasts are usually lower; integrated homecare services higher).

Recent developments

Consolidation & strategic M&A into homecare: large distributors and suppliers are buying specialist home-medical equipment providers to grow fee-for-service homecare footprints — e.g., Owens & Minor agreed to buy Rotech (home oxygen, CPAP, ventilator provider) for $1.36B (July 2024). This signals buyer appetite for scale and insurer/partner relationships in homecare.

Rapid growth of portable respiratory devices & remote monitoring: demand surged for portable oxygen concentrators, CPAP machines and remote patient monitoring during/after COVID; vendors are scaling POC, telehealth and connected consumable programs. (Portable O₂ market example: ~$1.7B in 2023 with multi-% CAGR projections).

Key drivers

Aging populations & rising chronic disease burden (COPD, OSA, diabetes, heart failure) — increases long-term home device needs (oxygen, CPAP, infusion/enteral pumps, mobility aids).

Shift to lower-cost care settings and payor incentives to move care from hospitals to home — drives demand for homecare devices and service models.

Technology & connectivity — IoT/remote monitoring, telehealth-enabled devices, and subscription/SaaS service models make home use safer and commercially attractive.

Restraints

Fragmented definitions & inconsistent reporting across analysts (device vs services) — leads to wide estimate ranges and complicates vendor benchmarking.

Reimbursement complexity & regulatory variation across countries — constrains device uptake in price-sensitive markets and slows new model rollout.

Supply & logistics for temperature/fragile equipment — distribution & post-sale service costs (maintenance, consumables, recall risk) can be high.

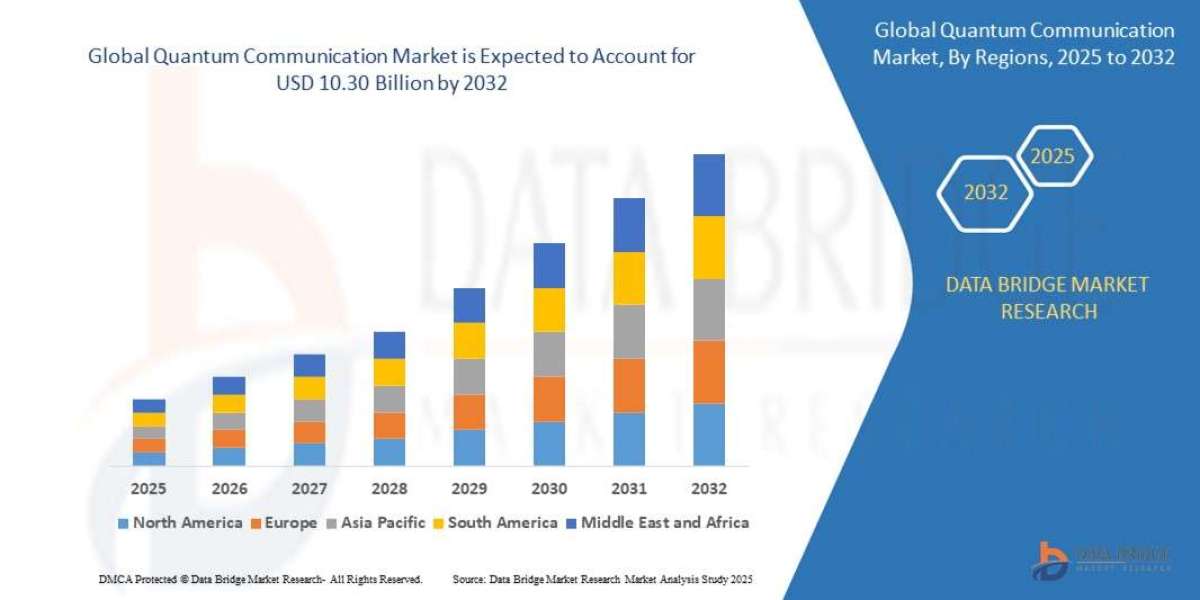

Regional segmentation (high level)

North America: largest and most mature market with strong insurer/payer reimbursement for durable medical equipment (DME), high per-capita device penetration.

Europe: mature but varied by country (wide adoption of home oxygen, infusion therapy, mobility aids; reimbursement varies).

Asia-Pacific: fastest growth potential (China, India, Japan, SE Asia) driven by ageing demographics, rising healthcare spend and homecare program expansion.

Latin America & MEA: smaller current shares but attractive for affordable, portable devices and telehealth expansion.

Emerging trends

Connected DME & remote patient monitoring (RPM): devices increasingly ship with connectivity and subscription analytics — creates recurring revenue.

Portable oxygen & home respiratory device innovation (lighter concentrators, longer battery life).

Distribution / payer partnerships & integrated service models: suppliers partnering directly with insurers or health systems to deliver end-to-end home therapy. M&A activity supports this shift.

Top use cases

Respiratory care — home oxygen (stationary & portable), CPAP/BiPAP for OSA, home ventilators.

Chronic disease management & infusion therapy — home infusion pumps, diabetes management (insulin pumps, CGM integration).

Mobility & ADL aids — wheelchairs, scooters, accessible beds and lifts.

Home diagnostics & monitoring — BP monitors, pulse oximeters, weight scales connected to RPM platforms.

Major challenges

After-sale service, maintenance & recall exposure (cost and liability).

Price pressure & competition from low-cost manufacturers (reduces margins on commoditized devices like BP monitors, basic oxygen concentrators).

Interoperability & data security for connected devices — a barrier for some healthcare customers and regulators.

Attractive opportunities

Subscription / as-a-service models (device + consumables + monitoring) that deliver recurring revenue and stronger customer lock-in.

Emerging markets uptake of cost-effective portable devices and telehealth services.

Premium services around respiratory & infusion care (clinical oversight, adherence programs) — higher margins than device sales alone.

Key factors of market expansion

Demographics (ageing & chronic disease prevalence) and payer incentives to reduce inpatient days.

Device connectivity + telehealth reimbursement (enables remote care models).

Distribution scale & partnerships with insurers/health systems to win fee-for-service contracts. Recent M&A underscores this.

Major companies — referenced values / what reports typically cite

Market reports most commonly report company role, product leadership, installed base, property counts or business-line presence rather than uniform “homecare-only” revenues in free summaries. Below are the major vendors that appear repeatedly across industry reports and what metrics / values reports usually highlight for each:

ResMed — market leader in sleep therapy (CPAP/BiPAP), strong presence in connected sleep-care services and cloud-based adherence programs; cited for high sleep device market share and recurring consumable revenue.

Philips (Philips Respironics / Philips Healthcare) — major supplier of home respiratory devices (oxygen systems historically via partners), sleep solutions, monitoring; reports cite product breadth and installed base.

Drive DeVilbiss Healthcare / Invacare / Sunrise Medical / Pride Mobility — leading mobility and DME manufacturers; reports cite property/bedside device counts and global distribution reach.

Medtronic / Abbott / Baxter / B. Braun — major players in home infusion, dialysis support, and chronic-care consumables; reports cite enterprise scale and therapeutic line revenues (company-level).

Fisher & Paykel Healthcare — recognized for home respiratory humidification & oxygen therapy components; cited for product innovation in respiratory care.

Rotech (now part of Owens & Minor via acquisition) — notable home oxygen/CPAP/ventilator services business; transaction value ($1.36B) cited as an indicator of strategic value in homecare.

Cardinal Health / Owens & Minor / Medline / McKesson (distributors / service providers) — often cited for distribution scale, DME logistics and payer contracts. Owens & Minor’s Rotech deal is a concrete example of distributor strategic moves.

Note on numeric values: Most free market summaries do not publish a clean “homecare-only” revenue line for diversified medical device companies. If you want exact numeric tables (e.g., FY2024 company revenue, estimated homecare/ DME segment revenue, number of DME units shipped, or vendor market-share %), I can fetch annual reports, investor presentations and paid report excerpts and compile a sourced table.

If you’d like, I can now do one of these immediately (with sources):

Top 20 vendors table with the metric each report cites (role, product focus, notable revenue figure or transaction like the Rotech buy) — CSV or formatted table.

Company financials for a selected vendor list (ResMed, Philips, Medtronic, Baxter, Owens & Minor, Invacare) — FY2023/2024 revenues and any public homecare/DME segment data I can find.

Region-by-region 2024 market size + CAGR (NA / EU / APAC / LATAM / MEA) as a downloadable CSV.

Pick one and I’ll compile the numeric, fully-sourced table right away.