Nice — here’s a compact, ready-to-use reference for the Hardware Security Solutions market: (A) a practical list of key companies (company · country · core value / product focus), and (B) concise, sourced notes for each requested topic (Recent developments, Drivers, Restraints, Regional segmentation, Emerging trends, Top use cases, Major challenges, Attractive opportunities, Key expansion factors). I used recent market reports and vendor pages (citations included).

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Hardware Security Solutions market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Hardware Security Solutions market.

Read complete report at: https://www.thebrainyinsights.com/report/hardware-security-solutions-market-14698

A. Key companies — quick reference (company · country · core value / specialty)

Thales · France — enterprise & cloud HSMs (Luna), payment HSMs (payShield), broad systems integrator for regulated sectors.

IBM · USA — on-prem and cloud HSM offerings, integration with enterprise key management and cloud services.

Utimaco · Germany — HSM hardware and compliance-focused crypto appliances for finance, government, telco.

Entrust / nCipher (Entrust) · UK/USA — HSMs (nShield), PKI and key management solutions for enterprises.

Futurex · USA — enterprise & cloud HSMs, payment HSMs and cryptographic key management solutions.

Yubico · Sweden / USA — hardware authentication tokens (YubiKey) and small-form HSM (YubiHSM) for MFA & device-backed keys.

Infineon Technologies · Germany — TPMs, secure elements, security controllers and silicon-root-of-trust for devices (automotive, IoT).

NXP Semiconductors · Netherlands/US — secure elements (EdgeLock), secure MCUs & provisioning tools for device identity and IoT HSM-like use cases.

Rambus · USA — silicon IP and secure root-of-trust IP, memory & interface security, tokenization/HSM adjacent products.

Cloud vendors / platform HSMs — AWS (CloudHSM / Nitro), Google (Cloud HSM / Titan), Microsoft Azure Key Vault HSM — cloud-native HSMs and KMS-backed hardware protections.

Other notable vendors/specialists: Fortanix (confidential computing & key management), HID Global (secure credentials), Atos / Thales (SafeNet), and many regional HSM integrators.

B. Market snapshot by requested topic

Recent developments

Market size estimates vary by report, but multiple recent market studies place the Hardware Security / HSM market around USD ~1.4–2.0 billion (2024–2025) with projected multi-year CAGRs commonly in the ~10–16% range driven by cloud migration, payments/custody, and regulatory needs.

Rising activity: cloud providers and HSM vendors are expanding cloud HSM and hybrid HSM services, and there’s growing demand for solutions supporting crypto custody, payment security, PKI, and post-quantum cryptography readiness.

Drivers

Cloud adoption & hybrid architectures — enterprises need cloud HSMs and on-prem-to-cloud key portability.

Payments, crypto custody & regulations — instant payments, fintech, and crypto-asset custody require certified HSMs (FIPS, PCI) and tamper-resistant key storage.

IoT / automotive / device identity — rising need for silicon-root-of-trust (TPMs, secure elements) in billions of connected devices.

Restraints

High cost of certified hardware & integration (certifications, lifecycle management, specialist skills).

Vendor concentration in certain segments (enterprise HSM dominated by a handful of players) and legacy lock-in challenges.

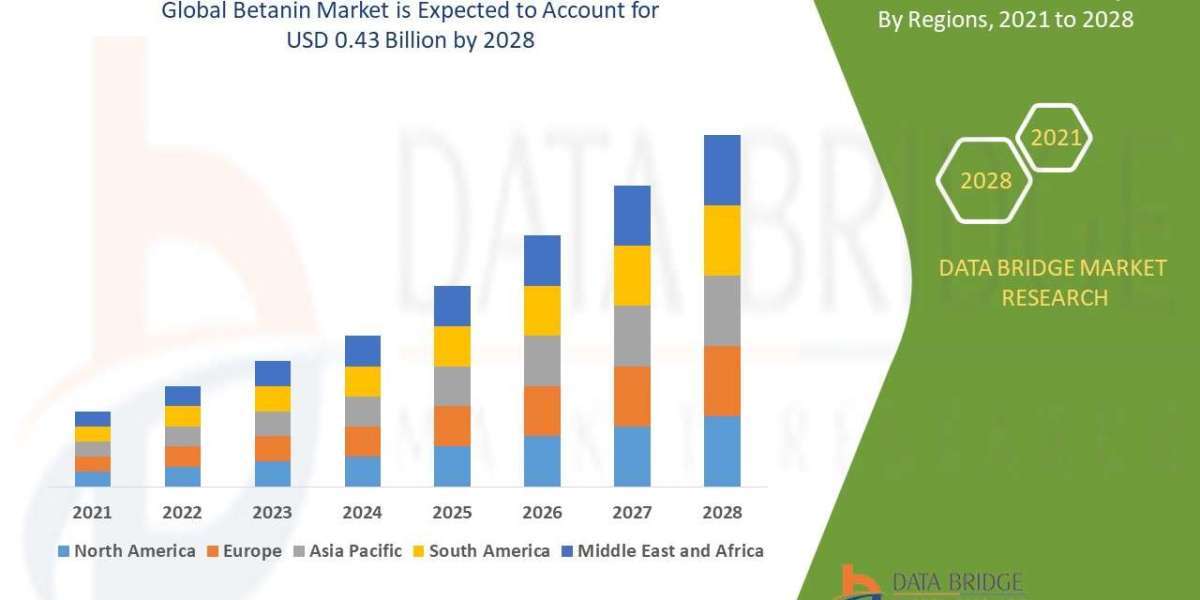

Regional segmentation analysis

North America — strong enterprise cloud, fintech, and hyperscaler activity (major demand for cloud HSMs & KMS).

Europe — large demand for on-prem/regulatory-compliant HSMs (finance, telecom, government); strong presence of European silicon/security vendors (Infineon, Utimaco, Thales).

APAC — fast growth driven by payments modernization, telecom (5G security), and large device markets (IoT/automotive).

Emerging trends

Cloud-native & hybrid HSM services (managed cloud HSM, BYOK/Bring-Your-Own-Key patterns).

Convergence with confidential computing & secure enclaves (Intel SGX, AMD SEV, TEEs) — hardware-backed runtime protections complement HSMs.

Post-quantum readiness & algorithm agility — vendors adding PQC capability planning and migration paths.

Growth of device-level security (TPM / secure element) for automotive, payment cards, and IoT provisioning.

Top use cases

Payment processing & card issuance (payment HSMs).

Cloud key management & crypto custody (exchange custodians, institutional crypto).

PKI & digital signatures / certificate authorities.

Device identity & secure provisioning for IoT/automotive.

Application encryption offload & secrets protection for enterprise apps and SaaS platforms.

Major challenges

Certification & compliance burden (FIPS 140-2/3, Common Criteria, PCI). Certification timelines/cost slow product updates.

Key lifecycle complexity & multi-cloud portability (moving keys across clouds/providers securely).

Supply-chain/security vulnerabilities at silicon or library level — hardware flaws (or crypto library issues) in tokens or secure elements can create long-lived risks. (example: past side-channel vulnerabilities that affected device families).

Attractive opportunities

Managed HSM & KMS services for mid-market (lower-cost subscription models).

Specialized HSMs for crypto-custody & DeFi institutionalization, plus certified payment HSMs for instant-payment rails.

Edge / device HSMs and secure provisioning services for automotive and IoT manufacturers (secure supply/production injection).

Key factors of market expansion

Regulatory & compliance drivers (payments, data privacy, crypto-custody) requiring tamper-proof key stores.

Cloud & hybrid architectures adoption — enterprises need HSM-backed KMS across multi-cloud environments.

Proliferation of connected devices — demand for secure elements/TPMs and provisioning tooling at scale.