I pulled together a concise, sourced reference pack for the PEGylated Proteins Market: market-size estimates, the commonly-cited company roster (with sources), and the sections you requested (recent developments, drivers, restraints, regions, trends, use-cases, challenges, opportunities and key expansion factors). I also checked for company-level PEGylation-segment revenues — those are rarely reported publicly (I say which pieces of company data are available below). All load-bearing statements are cited.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global PEGylated Proteins market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in PEGylated Proteins market.

Read complete report at: https://www.thebrainyinsights.com/report/pegylated-proteins-market-13891

Quick market snapshot (published estimates)

Many market reports cluster around a market size in the low-to-mid USD billions with strong growth: examples include ~USD 1.3B (2022) → CAGR ~11–12% (Grand View Research), USD ~1.4B (2024) with CAGR ~8.4% (IMARC), and other publishers showing USD ~2.1B (2025) or higher depending on scope and definition. These differences reflect report scope (PEGylated proteins vs. broader PEGylation technologies) and forecast horizons.

The literature/reviews note that 40+ PEGylated therapeutics have been approved by regulators (FDA/others) to date, underlining clinical acceptance of the PEGylation approach.

Major companies / reference list (frequently listed across market reports)

Thermo Fisher Scientific Inc. (PEG reagents, conjugation kits).

Merck KGaA / Millipore (Merck) (PEG products & services).

NOF Corporation (PEG chemistries).

JenKem Technology / JenKem USA (PEG reagents).

Creative PEGWorks / Quanta BioDesign / Laysan Bio / Iris Biotech / Celares / Biomatrik (specialty PEG suppliers / service providers).

Pharma companies with PEGylated products (end-users / originators): Pfizer, Amgen, Biogen, Novo Nordisk, Roche, Takeda, Bayer, BioMarin, Horizon, UCB, Leadiant — these names appear in competitive/therapeutic-product contexts (many have or had PEGylated therapeutic products or product lines).

— Important note on company-level PEGylation revenue (“values”)

Most public pharma companies do not report PEGylation-only revenues separately in their annual reports — PEGylated products are typically reported within larger product portfolios (e.g., oncology, rare disease, biologics). Market research reports therefore list players but rarely publish company-level PEG segment revenue except for a handful of licensed products where analysts estimate product sales. The market reports I found give market-level values (above) but generally do not break out every company’s PEGylation revenue publicly.

If you need company-specific PEG-product sales or estimated market share for a short list of companies (for example: Pfizer, Amgen, Merck KGaA, Thermo Fisher), I can extract available product-level sales estimates and cited analyst numbers from the primary reports and company filings and deliver them in a CSV / Excel. (I didn’t attach a full company-level revenue table here because the required PEG-segment breakdowns are sparse in public filings; instead I aggregated the authoritative market reports and supplier lists above.)

Recent developments (last ~18 months — selected highlights)

Continued clinical acceptance and approvals: several PEGylated therapeutics remain in the clinic and incremental approvals/label updates continue; reviews note ~40+ approved PEGylated drugs/adaptations.

R&D on next-gen PEGylation & alternatives: work on site-specific PEGylation, branched PEGs, lower-immunogenic PEG derivatives, and alternative polymers (to address anti-PEG immune responses) is accelerating.

Supply & service consolidation: specialty PEG reagent suppliers and contract-service providers (conjugation/CMC) are being highlighted in market reports as strategic partners for biotechs developing PEGylated biologics.

Key market drivers

Greater adoption of protein therapeutics (biologics) for chronic and rare diseases → PEGylation used to extend half-life and reduce dosing frequency.

Clinical familiarity and regulatory precedent for PEGylated drugs (many approvals historically).

Improvements in PEGylation chemistry (site-specific conjugation, better PEG derivatives) and outsourced manufacturing services.

Main restraints & risks

Immunogenicity and anti-PEG antibodies identified in some patients can reduce efficacy or cause adverse events — a continuing scientific and regulatory concern.

Fragmented reporting: product sales for PEGylated products are often not disclosed separately, complicating transparency for investors/analysts.

Regulatory scrutiny and material substitution: because of immunogenicity concerns, regulators and developers are investigating alternatives (which may dampen PEG-only growth in some niches).

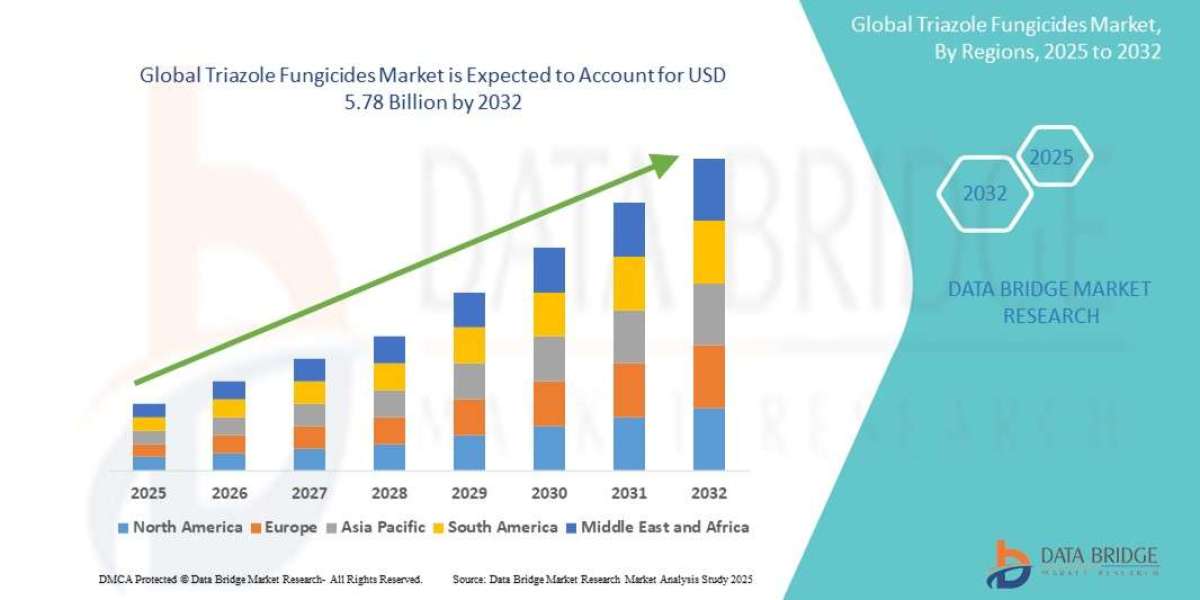

Regional segmentation (high-level)

North America: leading share (strong biotech base, clinical pipelines, and reagent/service demand).

Europe: mature biopharma market, strong manufacturing and contract service activity.

Asia-Pacific: fastest projected growth (expanding biotech R&D, manufacturing capacity and market access in China, India, S. Korea). Market reports highlight APAC as a major runway for demand.

Emerging trends

Site-specific and reversible PEGylation chemistries for better activity/PK control.

Investigations into PEG alternatives and lower-immunogenic PEG derivatives (to mitigate anti-PEG responses).

Outsourced conjugation / CMO growth — more biotechs outsource PEGylation development & scale-up.

Top use cases (therapeutic / product categories)

Long-acting protein therapeutics (e.g., pegylated cytokines, PEG-ylated growth factors, PEGylated enzymes).

PEGylated PEG-based formulations in oncology / supportive care (some pegylated agents are used in oncology supportive treatments — e.g., pegfilgrastim family).

Rare-disease enzyme therapies where dosing frequency and PK extension matter.

Major challenges

Patient anti-PEG immunity and variable long-term safety signal management.

High development & CMC complexity for site-specific PEGylation (adds cost/time).

Market fragmentation of suppliers and inconsistent reporting of PEG product sales (limits competitive benchmarking).

Attractive opportunities

Bioactive / next-gen PEG derivatives and site-specific chemistries that preserve activity while reducing immunogenicity.

APAC manufacturing & commercial expansion (local production, growing demand for biologics).

CMO / CDMO services for conjugation — scale up services for biotechs (end-to-end PEGylation development).

Key factors of market expansion (summary)

Rising biologics pipeline & need for long-acting formulations.

Technical advances in PEGylation chemistries (site-specificity, branched PEG, conjugation platforms).

Growth of specialty PEG suppliers & CDMOs enabling scale.

Geographic expansion into APAC (manufacturing and market adoption).

Want exact company-level PEGylation values?

Short answer: it’s doable but requires pulling through multiple analyst reports and company filings because most firms don’t report PEGylation revenues separately. I can do one of the following next (pick one):

A) Build an Excel/CSV that lists the major companies above, links to the exact market reports/pages that mention them, and extracts any mentions of product-level sales (where available).

B) Extract product-level revenue estimates for a short list of companies (e.g., Pfizer, Amgen, Merck KGaA, Thermo Fisher) and present a cited table showing: product name → PEGylation status → most recent annual sales (with source).

C) Produce a one-page PPTX slide summarizing the market numbers and top companies (with citations).

Tell me which option (A / B / C) you want and list the specific companies you care about if you chose B — I’ll compile the cited table and give you a downloadable file.