Got it — below is a compact, source-backed briefing for the Urinary Drainage Bags market: market sizing (range), key companies with concrete values/facts, and the sections you requested (Recent developments, Drivers, Restraints, Regional split, Emerging trends, Use cases, Challenges, Opportunities, and Key expansion factors). I used recent market reports and primary company filings/product pages so you can cite each claim.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Urinary Drainage Bags market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Urinary Drainage Bags market.

Read complete report at: https://www.thebrainyinsights.com/report/urinary-drainage-bags-market-12831

Market snapshot (numbers & why they vary)

Reported market-size estimates vary by scope and methodology. Representative figures: ~USD 1.0–2.1 billion (recent historical estimates) with forecasts to ~USD 2.5–2.9B by 2030–2032 and CAGRs in the ~3.8–4.9% range (different vendors use different definitions — some reports aggregate adjacent continence/collection product lines).

Key companies — concrete values / facts (company → short fact / value → source)

Coloplast A/S — major continence-care supplier. Reported DKK 27,030 million in revenue (FY 2023/24); continence-care (includes catheters & drainage solutions) is a core business area.

ConvaTec Group PLC — global wound & continence company with strong catheter/drainage product portfolio; reported ~$1.1 billion revenue in H1 2024 and full-year reporting shows multi-billion USD scale (annual results / investor materials).

B. Braun — broad medical-supplies OEM with adult leg/bedside urine bags (product pages show full product lines); B. Braun is a large medtech group supplying hospitals worldwide.

Teleflex (Rüsch) — urology product family (Rüsch belly bag, U-Bag) and related collectors showcased on product pages — an established OEM in catheter/drainage devices.

Cardinal Health / Medline / other distributors — major distributors and private manufacturers (Medline, Cardinal Health) offer bedside & leg bags and control a large share of hospital channel distribution. Product pages confirm broad SKU availability.

Note: many companies in this market are divisions of larger medtech groups (Coloplast, ConvaTec, B. Braun, Teleflex) while distributors and private firms (Medline, Cardinal) dominate hospital/retail channels. Market reports blend these players in their totals.

Recent developments

Multiple market reports (2022–2024) revised the market upward as demand from ageing populations and post-operative care remained steady; several analysts now place 2023/2024 market size near ~USD 1.6–2.1B depending on scope.

Product suppliers continue to emphasize anti-reflux, sampling ports, clamp/tap improvements and clamp-on CT/safety features—incremental product development aimed at infection control and usability (see product pages).

Drivers

Aging population & rising urinary incontinence prevalence — geriatric and post-operative patient growth increases demand for drainage systems.

Hospitalization & post-surgical care needs (catheterization after surgery) sustain bedside bag demand; home care growth lifts leg/ambulatory bag adoption.

Infection-control and product safety requirements (anti-reflux valves, sampling ports) push hospitals toward newer designs.

Restraints

Substitution by catheter alternatives and continence products (pads/absorbents) for some patient groups reduces lifetime bag demand.

Price sensitivity in emerging markets — lower-cost disposable alternatives and procurement pressure limit ASP growth.

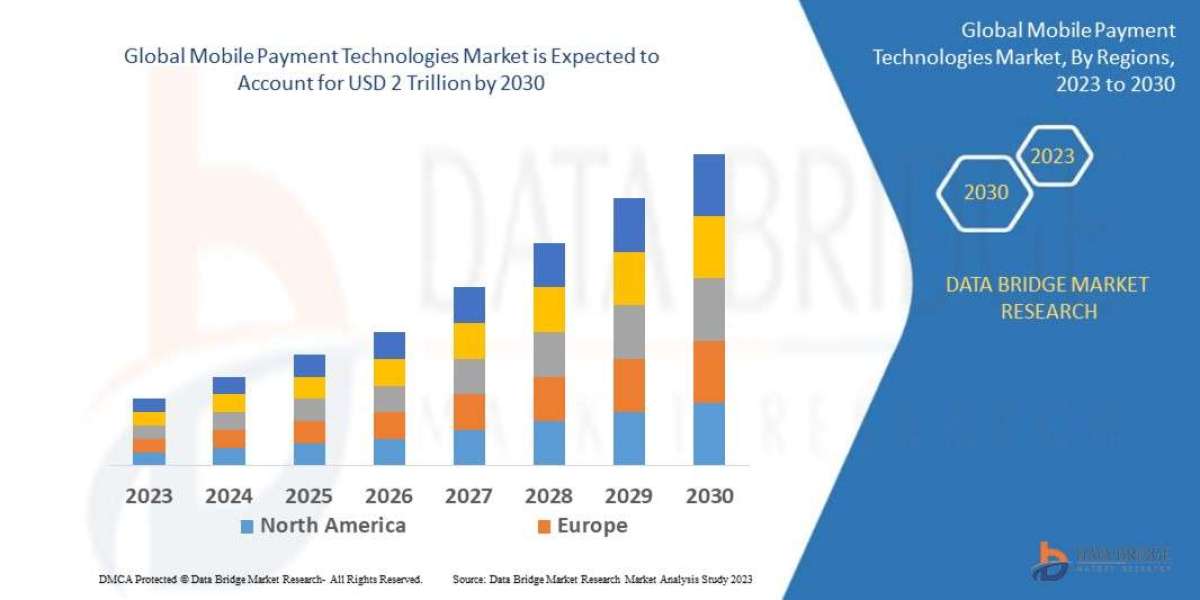

Regional segmentation analysis

North America — large hospital/long-term care market with high per-capita consumption and strong distributor networks (Cardinal, Medline).

Europe — mature continence market with major OEMs (Coloplast, ConvaTec, B. Braun) and high adoption of specialty drainage solutions.

Asia-Pacific (incl. India) — fastest projected growth (rising surgical volumes, ageing population, improving healthcare access). Country reports (e.g., India) show regional markets growing mid-single digits CAGR.

Emerging trends

Focus on infection-control design (anti-reflux, sampling ports, closed systems).

Shift to home-care & ambulatory solutions (leg bags, wearable belly bags) as more post-acute care shifts out of hospitals.

Consolidation of procurement via distributors and bundling of catheter + drainage solutions for pricing / logistics efficiency.

Top use cases

Inpatient post-operative urinary drainage (bedside/4L bags).

Ambulatory/long-term use (leg bags, belly/waist bags for catheterized ambulatory patients).

Urology clinics and home care (sampling ports for testing, anti-reflux safety).

Major challenges

Procurement cost pressure from hospitals and health systems — buyers seek lower cost solutions or bundled purchasing.

Regulatory & infection-control scrutiny — devices used in clinical settings face strict sterilization/packaging & supply-chain standards.

Fragmented vendor base at the distribution layer (large OEMs + many small manufacturers) — creates competitive pricing and variable quality.

Attractive opportunities

Home-care product lines (comfortable leg bags, wearable options) as more care moves to outpatient/home settings.

Product differentiation on infection control and measurement (metered bags, sampling ports) for clinical customers.

Emerging markets expansion — targeting India, China, SEA where surgical volumes and long-term care penetration are growing.

Key factors of market expansion

Demographic trends: ageing populations and higher incontinence prevalence.

Growth of post-operative care & ambulatory care models that require reliable drainage solutions.

OEM & distributor penetration into home-care channels and improved supply logistics.

Incremental product innovation (safety, sampling, usability) that drives replacement and upgrade cycles.