I pulled recent market reports and company disclosures and built a concise, citation-backed brief for the Pharmaceutical Packaging Equipment Market, plus a short table of major companies with recent “values” (revenues / order intake /reported turnover) where public figures were available. I focused on widely-cited market reports and company filings/press releases so you can use these as references.

This versatile research report is presenting crucial details on market relevant information, harping on ample minute details encompassing a multi-dimensional market that collectively maneuver growth in the global Pharmaceutical Packaging Equipment market.

This holistic report presented by the report is also determined to cater to all the market specific information and a take on business analysis and key growth steering best industry practices that optimize million-dollar opportunities amidst staggering competition in Pharmaceutical Packaging Equipment market.

Read complete report at: https://www.thebrainyinsights.com/report/pharmaceutical-packaging-equipment-market-12561

Quick company reference table (company → recent reported value / metric)

Syntegon Technology GmbH (ex-Bosch Packaging) — Order intake 2024: €1.8 billion; 2024 revenue €1.6 billion; strong Pharma Liquid / aseptic growth highlighted in 2024 results.

IMA Group (I.M.A. Industria Macchine Automatiche S.p.A.) — Group revenue (recent historical): ~€2.0+ billion (2022–2024 reporting range / group disclosures and analyst commentary). (Group remains one of the largest players globally).

Marchesini Group — Turnover ≈ €591M (2023) — over €600M reported for 2024 consolidated turnover in company communications.

Uhlmann Pac-Systeme GmbH & Co. — Major global player (no single public consolidated figure in the sources used here; typically listed among top 5–8 vendors in industry reports).

Romaco Group, Coesia S.p.A., Körber AG (incl. pharma brands), Bausch+Ströbel, OPTIMA, MULTIVAC — listed repeatedly as top global vendors in market reports and vendor rankings. (Individual revenues vary; many report in corporate financials or as group segments).

Market snapshot & references (high-level)

Market size & growth: Multiple market reports place the market in the multi-billion USD/EUR range and projecting healthy CAGR through the late 2020s (example: ResearchAndMarkets estimated the market ~USD 13.27B in 2025 and high single-/double-digit CAGR projections in various forecasts).

Who the reports list as top players: Syntegon, IMA, Körber, Coesia, Marchesini, Romaco, Uhlmann, Bausch+Ströbel, OPTIMA, MULTIVAC and others — consistently named across MarketsandMarkets, Grand View Research, ResearchAndMarkets and specialist listings.

Recent Development

Rising order intake and strong revenues for leading suppliers driven by demand for aseptic/biologics fill-finish and cartridge/pen/autoinjector production — Syntegon reported strong 2024 order intake and improved EBITDA (company disclosure).

Consolidation and M&A activity (groups acquiring niche automation / robotics / inspection businesses) continues as vendors broaden end-to-end line offerings.

Drivers

Strong global pharmaceutical production (esp. biologics, injectables, high-value therapies).

Regulatory pressure for serialization, track & trace, tamper-evidence and stricter aseptic standards.

Demand for automation, line flexibility and rapid format changeover to support personalized / low-volume high-mix runs.

Restraints

High capital cost of advanced aseptic/containment equipment and long payback for smaller manufacturers.

Supply chain pressures and periodic soft demand in some end-markets (example: Gerresheimer guidance revisions in 2025 indicate variability in end-market demand for certain packaging segments).

Regional segmentation analysis (typical, per reports)

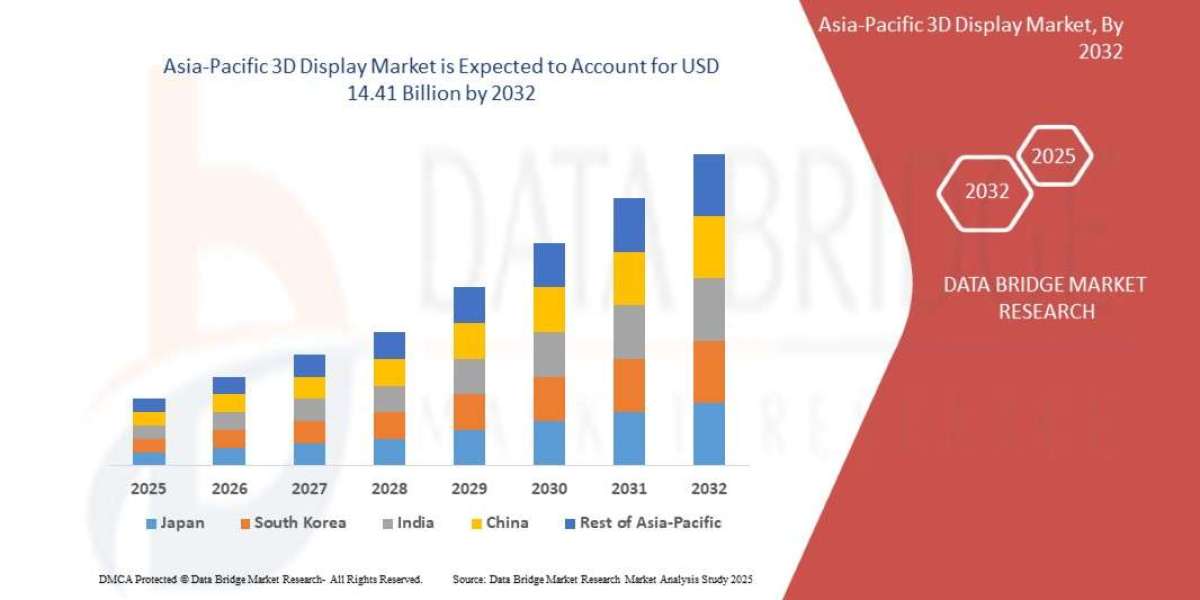

Asia-Pacific: large and growing share (manufacturing base, contract manufacturers).

Europe: strong in high-end equipment vendors & R&D (Packaging Valley in Italy, German vendors).

North America: large installed base, high demand for biologics / sterile fill & finish capacity.

Emerging trends

Aseptic/containment & isolator systems for biologics and high-potency compounds.

Digitalization & Industry 4.0: condition monitoring, remote validation, track & trace integration.

Flexible, modular lines (to serve personalized medicines, trials, CDMOs).

Top use cases

Parenteral filling (vials, cartridges, prefilled syringes, pens) — aseptic filling lines.

Solid dose packaging (blistering, cartoning) for high-volume oral drugs.

Secondary packaging & serialization for regulatory compliance and anti-counterfeiting.

Major challenges

Validations / regulatory approvals for new lines (time & cost).

Skilled labor shortage for complex equipment commissioning and maintenance.

Capital intensity plus vendor consolidation creating negotiation pressure on prices/lead times.

Attractive opportunities

CDMOs & regional capacity build-outs — outsourcing growth creates demand for turnkey lines.

Biosimilars & anti-obesity biologics — growing therapy areas requiring fill-finish capacity. (Syntegon highlighted biologics / anti-obesity demand in 2024 reporting).

Retrofit & upgrade services — existing installed base can be modernized with digital/serialization features.

Key factors of market expansion (summary)

Pharma production growth (particularly biologics and injectables).

Regulatory & serialization requirements forcing new equipment adoption.

Automation, modularity and digital services as manufacturers seek productivity and flexibility.